Best Personal Loans for Fair Credit

Get pre-qualified for a personal loan in just minutes. Checking rates won’t affect your credit score

How to Get a Personal Loan for Fair Credit

Obtaining a personal loan with fair credit may require some additional effort, but it's still possible. To increase your chances, focus on improving your credit by making timely payments, reducing credit card balances, and addressing any credit report errors. Be sure to research lenders who cater to borrowers with fair credit or explore options like credit unions and online lenders.

Applying for a personal loan with fair credit is simple.

Compare personal loan rates

Compare personal loan rates in July, 2025

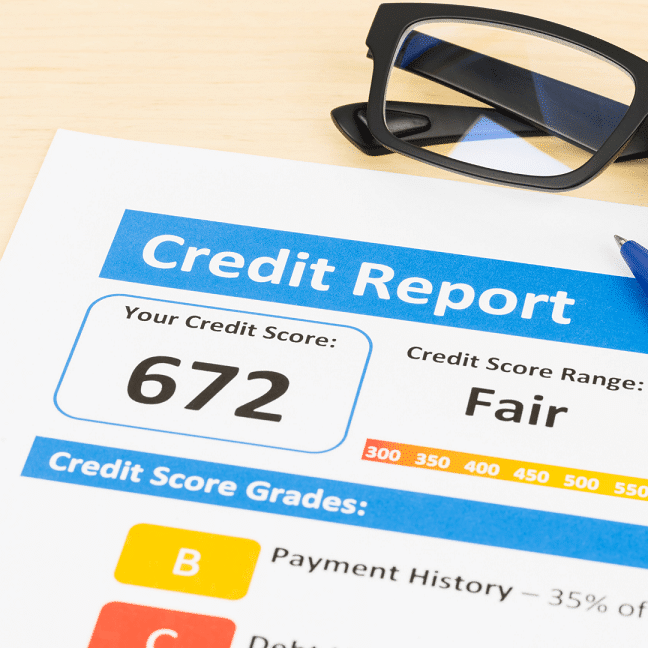

What is fair credit?

According to the FICO credit scoring model, which ranges from 300 to 850, "fair credit" typically corresponds to credit scores in the range of 580 to 669. This range suggests a credit profile that may have some negative elements, such as late payments, high credit utilization, or limited credit history. While individuals with fair credit may still qualify for loans and credit, they may face higher interest rates and less favorable terms compared to those with higher credit scores.

Can I get a personal loan with fair credit?

While having fair credit may pose some challenges, it doesn't mean you're entirely locked out of obtaining a personal loan. Lenders understand that credit scores don't define your entire financial situation. They take into account other factors like income, employment history, and overall financial stability. So, even with fair credit, you still have a shot at securing a personal loan. It's important to do your research, explore lenders who specialize in working with borrowers with fair credit, and highlight any positive aspects of your financial profile. Be prepared to provide explanations for any past credit issues and demonstrate your ability to handle the loan responsibly.

How much does a fair credit personal loan cost?

The cost of a personal loan can vary depending on several factors, including the loan amount, interest rate, loan term, and any additional fees or charges. With fair credit, it's possible that the interest rates offered to you may be slightly higher compared to those with excellent credit. Higher interest rates can result in a higher overall cost of the loan.

To get an accurate estimate of the cost, you would need to consider the specific loan terms and interest rates offered to you by lenders. It's important to shop around and compare offers from different lenders to find the most competitive rates and terms available to borrowers with fair credit.

Additionally, keep in mind that some lenders may charge origination fees or other fees associated with processing the loan. These fees can also contribute to the overall cost of the loan.

What can I do to improve my fair credit score?

If you have a fair credit score, you’re in a good position to improve it quickly. Here are some of the things you should consider doing:

- Pay down your current debt – if you have high credit utilization, it’s a good idea to pay it down before you think about taking out another loan. Credit utilization is the percentage of credit you’ve used against how much you can borrow. For example, if the total amount of credit you have access to is $10,000, and you’ve only used $1,000, your credit utilization is 10%. The recommended credit utilization amount is 30%, so consider paying off debt before taking out more.

- Avoid missed payments – if you get paid irregularly, you may be reluctant to set up automatic payments, but a missed payment or two can seriously harm your credit score. Set up automatic payments for the minimum and then make additional payments for more when you can.

- Don’t open new accounts too often – it can be tempting to get that new store card for that 20% off, but store cards often have a low barrier to entry but will still mark as new credit on your score. While a store card can be a great way to kickstart a credit score for a young person, having dozens of them opened up every few months may do more harm than good – especially if you leave a balance on them.

- Monitor your score – we often don’t think about our credit score until we’re thinking about getting a new credit card or loan, but there are plenty of free services that will help you monitor your score. Look out for any errors and have them corrected if necessary.

- Follow tips, but don’t look for overnight fixes – a credit score takes time to build, so be wary of any form of credit or anyone saying they can help you drastically improve your score overnight.

Quick links

Ready to apply for a fair credit personal loan? Get started today.

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

How Pasha Funding Works

Compare personal loan rates

What’s the best type of personal loan for fair credit?

When it comes to the best type of personal loan for fair credit, a secured personal loan or a cosigned loan can be viable options to consider. Here's why:

Secured Personal Loan: A secured personal loan requires collateral, such as a savings account, a vehicle, or other assets. By securing the loan with collateral, you provide additional assurance to the lender, which may increase your chances of approval. Secured loans often come with lower interest rates compared to unsecured loans since there is less risk for the lender. However, it's important to remember that if you default on the loan, the lender can seize the collateral.

Cosigned Loan: A cosigned loan involves having someone with good credit, such as a family member or trusted friend, co-sign the loan with you. The cosigner's strong credit history and financial stability can help offset the potential risks associated with your fair credit. This arrangement can improve your chances of getting approved for a loan and may result in more favorable loan terms, including lower interest rates.

While secured personal loans and cosigned loans can be beneficial for individuals with fair credit, it's essential to carefully consider your options and evaluate the terms and conditions offered by different lenders. Remember to choose a loan that aligns with your financial situation and goals while being mindful of the potential risks and responsibilities involved.

Are there alternatives to personal loans for borrowers with fair credit?

There are alternative options available to individuals with fair credit who are applying for a personal loan. Consider the following possibilities:

- Credit cards: If you require a smaller amount of money or need emergency funds, a credit card can be a suitable solution, provided you use it responsibly. It's important to manage your credit card debt effectively and make timely payments to avoid accruing high interest charges.

- Cash advance: Some credit cards offer the option of obtaining a short-term loan through a bank or ATM. This can be a viable choice if you need immediate cash, but be aware that additional fees are typically associated with cash advances.

- 401(k) loan: If your employer's retirement plan allows it, you may be able to borrow funds from your 401(k). This option requires careful consideration, as it involves borrowing from your future self. Ensure that you have a stable financial situation and can repay the loan within the specified timeframe, usually five years or less.

- Car loan: If you are in the market for a new vehicle, obtaining car finance through the dealership you are working with can be advantageous. The loan is secured against the car you purchase, which may increase your chances of approval even with fair credit.

- Overdraft: If you have a good relationship with your bank, you may have the option to apply for an overdraft. An overdraft allows you to borrow money when you exceed the balance in your bank account. However, be cautious as overdrafts can come with high fees and may deplete your deposited funds each month. Use overdrafts sparingly and be mindful of the associated costs.

What do I need to apply for a personal loan with fair credit?

When applying for a personal loan with fair credit, you'll typically need to gather and provide several documents and pieces of information to support your application. Here's a list of what you may need:

- Personal identification: A valid government-issued identification document, such as a driver's license, passport, or ID card.

- Proof of income: Recent pay stubs or tax returns to verify your income. If you're self-employed, you may need to provide additional documentation, such as bank statements or profit and loss statements.

- Employment information: Details about your current employment, including the name of your employer, your job title, and the duration of your employment.

- Financial information: A summary of your financial situation, including bank account statements, investment statements, and any other relevant financial documents.

- Credit history: While the lender will likely review your credit history themselves, it can be helpful to have a copy of your credit report on hand to review and address any potential inaccuracies.

- Debt information: A list of your current debts, including credit cards, student loans, auto loans, or any other outstanding loans.

- Purpose of the loan: Be prepared to explain how you plan to use the funds from the personal loan. This can help the lender assess the suitability of the loan for your specific needs.

- Collateral (if applicable): If you're applying for a secured personal loan, you may need to provide documentation related to the collateral you're offering, such as property documents or vehicle information.

In some cases, you may need to send proof of income before they’ll make their final approval. You will have a little time to do this if asked, so don’t panic. They’ll usually ask for proof of income, such as your pay stubs or bank statements.

How do I choose a fair credit personal loan lender?

If you’re planning to take out a personal loan with fair credit, go into it calmly – don’t rush into anything and take some time to think about whether borrowing this money is right for you. Also consider:

- High-interest rates – personal loans are usually better for this than credit cards because your set monthly payments will pay off the loan in the determined time, but don’t forget that the interest rate increases the cost of the loan.

- Look at additional fees – some lenders will tack on additional fees, so keep an eye out for those and how much they may increase the cost of the loan.

- Look at the repayment terms – don’t take a loan that won’t allow you to pay it off early if you choose, or that charges an early repayment fee. Also look at other terms, as some allow you to choose your monthly payment date or give you a few payment “holidays” which allow you to opt to skip a payment in an emergency.

Browse personal loans by amount:

- $5k Personal Loans

- $10k Personal Loans

- $25k Personal Loans

- $35k Personal Loans

- $50k Personal Loans

- $75k Personal Loans

- $100k Personal Loans

Additional resources

Federal Trade Commission (FTC): The FTC is a U.S. government agency that focuses on consumer protection. They provide guidance on various financial topics, including personal loans. You can find information on understanding personal loans and tips for borrowing wisely on their website.

U.S. Small Business Administration (SBA): Although primarily focused on assisting small businesses, the SBA offers resources and information on personal loans for business purposes. It can be helpful for entrepreneurs seeking loans to fund their ventures.

Consumer Financial Protection Bureau (CFPB): The CFPB is another U.S. government agency that provides consumer financial information and resources. They cover various aspects of personal loans, including understanding loan terms, comparing offers, and avoiding scams.

How to qualify for fair credit personal loans

Qualifying for fair credit personal loans may require a bit of effort, but it's definitely possible. Here are some steps you can take to improve your chances:

- Check and understand your credit: Start by reviewing your credit report to ensure its accuracy and identify any areas that need improvement. Understand what factors contribute to your fair credit score and work on addressing them.

- Research lenders: Look for lenders that specifically cater to individuals with fair credit or those who consider a broader range of credit profiles. Online lenders, credit unions, and community banks may be more flexible in their lending criteria.

- Improve your creditworthiness: While you may not be able to change your credit score overnight, there are actions you can take to enhance your creditworthiness. Make all payments on time, reduce credit card balances, and avoid taking on new debt.

- Provide additional documentation: To strengthen your loan application, consider providing supplementary documentation such as proof of stable employment, income, and assets. This can demonstrate your financial stability and ability to repay the loan.

- Consider a co-signer: Having a co-signer with good credit can significantly increase your chances of qualifying for a personal loan. Their strong credit profile can help offset any concerns the lender may have regarding your fair credit.

- Shop around and compare offers: Obtain loan quotes from multiple lenders and compare interest rates, fees, and loan terms. This allows you to find the best possible loan offer that suits your needs and financial situation.

- Prepare a strong application: Fill out the loan application accurately and provide all required documentation promptly. Present your case in a clear and organized manner, emphasizing your ability to repay the loan despite your fair credit.

Personal Loans for Every Occasion

Find Your Best Rate

Compare Best Personal Loans

Personal Loan Payoff Calculator

Personal Loan Lender Reviews

Personal Loans By Credit

Personal Loans for Fair Credit

Personal Loans for Good Credit

Personal Loans for Excellent Credit

Personal Loan Types

Auto Repair Loans

Credit Card Consolidation Loans

Fast Personal Loans

Home Improvement Loans

Horse Barn Financing

Wedding Loans

Family Planning Loans

Funeral Financing

Land Purchase Financing

Manufactured Home Financing

Medical Loans

Cosmetic & Plastic Surgery Financing

Owner Builder Construction Loans

Personal Loans for House Down Payment

Personal Loans for Self Employed

Personal Loans for Furniture Expenses

Student Loans

Debt Consolidation Loans

Vacation & Travel Loans

Emergency Personal Loans

Personal Loans with Co-signers

Home Improvement Financing

Appliance Financing

Bathroom Remodel Financing

Basement Remodel Financing

Boat Dock Loans

Deck Financing

Driveway Paving Financing

Fence Financing

Flooring Financing

Furnace Financing

Garage Financing

Home Addition Financing

Hot Tub Financing

HVAC Financing

Home Insulation Financing

Interior & Exterior Painting Financing

Kitchen Remodel Financing

Kitchen Cabinet Financing

Pole Barn Financing

Roof Financing

Solar Panel Financing

Swimming Pool Financing

Sunroom Addition Loans

Window Replacement Financing

Loan rate & terms disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.