Best Home Improvement Loans of July, 2024

Get pre-qualified for a home improvement loan in just minutes. Checking rates won’t affect your credit score

Home Improvement Loans for Good & Bad Credit

Get funded from $2,000 - $100,000 towards home improvement upgrades and repairs and compare the best competitive rates from top personal lenders in just minutes.

Applying for home improvement financing is fast and easy:

Compare Home Improvement Loans

Compare personal loan rates in July, 2024

At some point, all homes need a little tender loving care. Styles change, things wear out, paint gets scuffed, and you just know it’s time for a makeover. If that’s just a couple of cans of paint it’s not a problem but as soon as you start thinking of new floor coverings, furniture, lighting, and the rest, the game changes. And if you’re thinking of putting in a new kitchen, bathroom, or an addition - costs can escalate very quickly.

If you’re one of the few with a pile of savings available you can self-finance the project but this is not the case for the majority of homeowners. Either they want to keep their savings as an investment for the future or they simply don’t have the cash to splash. This is where home improvement loans can be the answer to the situation.

What are home improvement loans?

A home improvement loan is a financial product designed to provide individuals with the necessary funds to enhance or renovate their residential property. This type of loan enables homeowners to tackle various projects such as remodeling the kitchen, adding an extra room, or upgrading the bathroom, among others. Unlike traditional mortgages, home improvement loans are typically smaller in amount and are specifically tailored to cover the costs associated with home renovations. These loans can be obtained from banks, credit unions, or online lenders, and they are often secured by the equity in the property, meaning that the house serves as collateral. By obtaining a home improvement loan, homeowners can bring their renovation ideas to life and increase the value, comfort, and aesthetic appeal of their homes.

How do home improvement loans work?

Home improvement loans provide homeowners with funds to finance renovation projects. Borrowers apply for a loan, and if approved, receive a specific amount of money. The loan is repaid through regular installments over a fixed period, with interest rates varying based on the lender and loan type. These loans can be secured (requiring collateral) or unsecured. Homeowners should carefully consider costs and affordability before committing to a loan.

Types of home improvement loans

Below are some of the most popular types of home improvement financing options:

- Home Equity Loan: A home equity loan is a great option for homeowners who have built up significant equity in their property. It allows you to borrow against the value of your home and use the funds for renovations. This type of loan offers competitive interest rates and a lump sum payout, making it ideal for larger projects.

- Personal Loan: If you don't have substantial home equity or prefer not to use it as collateral, a personal loan can be a convenient choice. Personal loans are unsecured, meaning you don't have to put up your home as collateral. They provide flexibility in terms of loan amount and repayment period, making them suitable for smaller to medium-sized projects.

- Home Improvement Line of Credit: A home improvement line of credit functions similarly to a credit card. It gives you access to a predetermined credit limit that you can draw from as needed for home improvements. This option is great for ongoing or multiple projects since you only pay interest on the amount you use. It offers flexibility and convenience.

- Contractor Financing: Some contractors and home improvement companies offer their own financing options to help homeowners fund their projects. These financing plans may come with promotional offers, such as zero or low-interest rates for a limited time. It can be a convenient choice if you're working with a specific contractor and need financing tailored to your project.

- Government Programs and Grants: Various government programs and grants are available to assist homeowners with specific home improvement projects. These programs often come with favorable terms, low-interest rates, or even grants that do not require repayment. Researching and applying for such programs can help reduce the financial burden of your renovations.

How much can I borrow with a home improvement loan?

The amount you can borrow with a home improvement loan depends on several factors, including the lender's policies, your creditworthiness, the value of your property, and the specific details of your project. Generally, home improvement loans can range from a few thousand dollars to hundreds of thousands of dollars.

For smaller projects, lenders may offer unsecured personal loans with limits typically ranging from $1,000 to $50,000. If you have substantial equity in your home, a home equity loan or a home equity line of credit (HELOC) may allow you to borrow a larger amount, often up to 85% of the appraised value of your home, minus any outstanding mortgage balance.

It's important to note that borrowing the maximum amount offered may not always be the best choice. Consider your budget, the cost of your renovation project, and your ability to comfortably repay the loan before determining the appropriate loan amount for your needs. It's recommended to shop around, compare loan options, and consult with lenders to understand the specific borrowing limits they offer based on your circumstances.

What type of loan is best for home improvements?

Which loan you choose depends on you, your financial situation, and the amount of money involved. Credit cards are great for low-cost short-term projects but you may want to look at lower-cost solutions for more involved renovations.

Other types of home improvement loans may take longer to organize but will be more cost-effective in the long term.

Quick links

Ready to apply for a home improvement loan? Get started.

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

How Pasha Funding Works

Compare personal loan rates

Pros and cons of home improvement financing

PROS

- Access to Funds: Home improvement financing provides homeowners with the necessary funds to undertake renovation projects without depleting their savings or disrupting their cash flow. This allows you to enhance your home's comfort, functionality, and aesthetic appeal.

- Flexible Loan Options: There are various types of home improvement financing options available, such as home equity loans, personal loans, and lines of credit. This provides flexibility in terms of loan amount, repayment period, and interest rates, allowing you to choose an option that best suits your needs and financial situation.

- Increased Property Value: Well-planned and executed home improvements can increase the value of your property. This can be beneficial if you plan to sell your home in the future, as it can potentially lead to a higher selling price and a better return on investment.

- Potential Tax Benefits: In some cases, the interest paid on home improvement loans may be tax-deductible, particularly if the renovations increase your home's energy efficiency. This can help reduce your overall tax liability, providing potential financial benefits

CONS

- Interest and Fees: Home improvement financing typically comes with interest charges and fees, which add to the overall cost of the project. It's important to carefully consider the total cost of borrowing, including these expenses, to ensure that the benefits of the renovation outweigh the financial burden.

- Debt Obligation: Taking on a home improvement loan means taking on additional debt. It's crucial to assess your ability to comfortably manage the loan payments alongside your existing financial obligations. Failure to repay the loan on time can negatively impact your credit score and put your home at risk if it's used as collateral.

- Potential Over-Improvement: While home improvements can enhance your living space and property value, it's important to strike a balance. Over-improving your home by exceeding the value of comparable properties in your area may not yield a proportional return on investment when you sell.

- Qualification Requirements: Obtaining home improvement financing may require meeting certain qualification criteria, such as having a good credit score, stable income, and equity in your home. Not meeting these requirements could limit your options or result in higher interest rates.

When should you consider a home improvement loan?

Home improvement loans can be used for a variety of purposes. Below are the most common renovations:

- Kitchen Remodeling: Update appliances, countertops, cabinets, flooring, and lighting.

- Bathroom Renovation: Upgrade fixtures, add a new shower or bathtub, install new tiles, or improve ventilation.

- Room Addition: Build an extra bedroom, expand the living space, or create a home office.

- Roof Repair or Replacement: Address leaks, fix damages, or install a new roof.

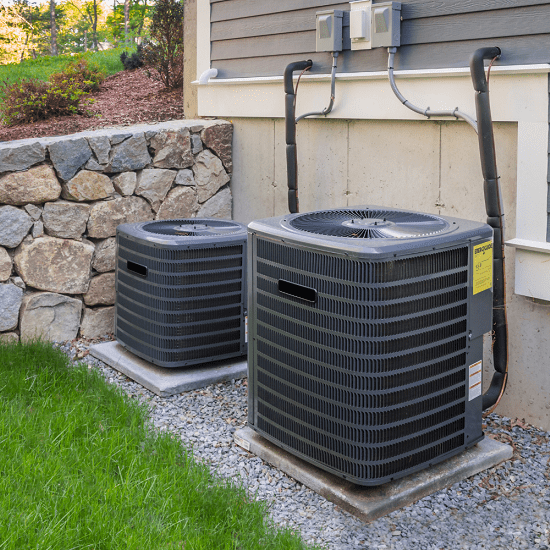

- HVAC System Upgrade: Install a new heating, ventilation, and air conditioning system for improved energy efficiency and comfort.

- Window Replacement: Upgrade to energy-efficient windows or replace old, worn-out ones.

- Exterior Renovation: Enhance curb appeal with new siding, paint, landscaping, or a new front door.

- Basement Finishing: Convert an unfinished basement into usable living space, such as a recreation room or a guest suite.

- Deck or Patio Construction: Build an outdoor entertaining area for relaxation and socializing.

- Flooring Upgrades: Replace carpets with hardwood, laminate, or tile flooring.

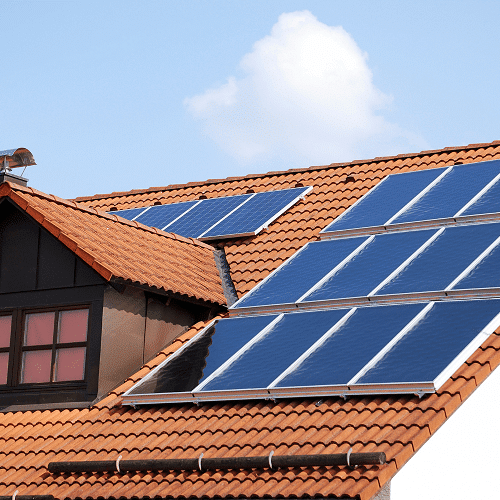

- Energy-Efficiency Improvements: Install solar panels, upgrade insulation, or replace old appliances with energy-efficient models.

- Garage Conversion: Transform a garage into a living space, home gym, or studio.

- Accessibility Modifications: Install ramps, widen doorways, or add handrails to accommodate individuals with disabilities or mobility challenges.

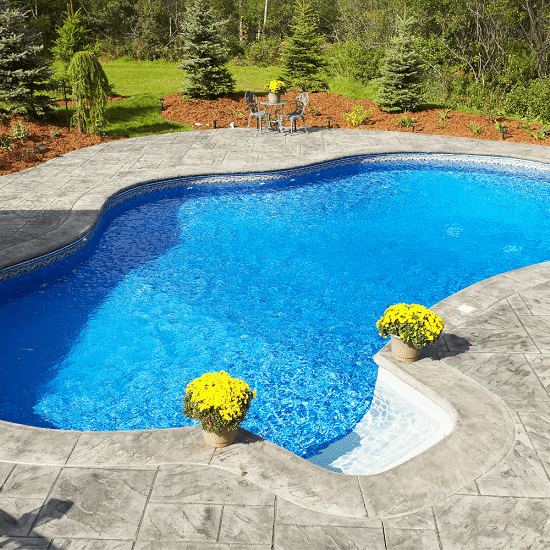

- Pool Installation or Renovation: Build a new pool or renovate an existing one to enhance outdoor enjoyment.

- Plumbing and Electrical Updates: Replace outdated plumbing or electrical systems to improve functionality and safety.

What credit score do I need to qualify for a home improvement loan?

The credit score required to qualify for a home improvement loan can vary depending on the lender and the specific loan product. Generally, a higher credit score increases your chances of getting approved for a loan and obtaining more favorable terms, such as lower interest rates.

While specific credit score requirements may vary, here's a general guideline:

- Good to Excellent Credit (670 and above): A credit score in this range is typically considered good to excellent and may qualify you for most home improvement loans with competitive interest rates and favorable terms.

- Fair Credit (580 to 669): With a credit score in this range, you may still be able to qualify for a home improvement loan, although you may encounter higher interest rates or more stringent qualification criteria.

- Poor Credit (below 580): It may be more challenging to qualify for a traditional home improvement loan with a poor credit score. In such cases, alternative financing options, such as secured loans or loans from specialized lenders, may be available, but they might come with higher interest rates and stricter terms.

What is the average interest rate for a home improvement loan?

The average interest rate for a home improvement loan can vary depending on factors such as the lender, loan type, loan amount, borrower's creditworthiness, and prevailing market conditions. However, as of my knowledge cutoff in September 2021, the average interest rates for home improvement loans ranged from around 5% to 15%.

Home Improvement Loan Calculator

Total Payment

-

Total Interest

-

Monthly Payment

-

Ready to apply for a personal loan?

Compare rates from top lenders with no impact on your credit, ever.

How do I qualify for a home improvement loan?

To qualify for a home improvement loan, there are several factors that lenders typically consider. While specific requirements may vary between lenders and loan products, here are some common qualifications:

- Creditworthiness: Lenders assess your credit history and credit score to evaluate your ability to repay the loan. A higher credit score generally improves your chances of qualifying for a loan and obtaining more favorable terms. Good credit management, such as paying bills on time and keeping credit utilization low, can help strengthen your creditworthiness.

- Income and Debt-to-Income Ratio: Lenders review your income to ensure you have sufficient funds to repay the loan. They calculate your debt-to-income ratio, comparing your monthly debt payments to your income. A lower debt-to-income ratio demonstrates greater repayment capacity and increases your chances of loan approval.

- Home Equity: For certain types of home improvement loans, such as home equity loans or home equity lines of credit (HELOCs), having substantial equity in your home is often required. Lenders may consider the loan-to-value ratio, which is the percentage of your home's value that you owe on your mortgage.

- Loan Documentation: You will typically need to provide documentation, including proof of income (such as pay stubs or tax returns), bank statements, identification, and details about the proposed home improvement project. Lenders may also require an appraisal of your property to determine its value.

- Loan Purpose and Project Details: Clearly outlining the purpose of the loan and providing details about the planned home improvement project can enhance your chances of loan approval. Lenders want to ensure that the funds will be used for legitimate home improvements that will increase the value of the property.

- Employment and Stability: Lenders may assess your employment history and stability to gauge your ability to make consistent loan payments. A steady job and income stability can strengthen your loan application.

Are home improvement loans tax deductible?

It depends. Loan interest on a home improvement loan can be deducted from your taxes. However, the loan must be secured by your primary residence and must be used to “significantly improve” the securing property.

Will a home improvement loan add value to my house?

A well-planned and executed home improvement project has the potential to add value to your house. However, the actual impact on your property's value can vary depending on several factors, including the type of renovation, the local real estate market, and the overall quality of the work. Here are a few key points to consider:

- Renovation Type: Certain types of renovations tend to have a higher return on investment (ROI) and can significantly enhance your home's value. Examples include kitchen and bathroom remodels, adding additional living space, upgrading energy-efficient features, and improving curb appeal.

- Quality and Design: The quality of the renovation work and the design choices made can influence the perceived value of your home. High-quality craftsmanship, attention to detail, and using materials that align with current trends and buyer preferences can have a positive impact on your property's value.

- Local Real Estate Market: The state of the local real estate market plays a role in determining how much value a home improvement project will add. In a strong seller's market where demand is high, renovations that improve the appeal and functionality of your home can lead to a higher selling price. However, in a buyer's market with more inventory and fewer buyers, the impact on value may be less pronounced.

- Over-Improvement: It's important to be mindful of over-improving your home, where the cost of the renovation exceeds the market value of comparable properties in your area. While the improvements may still enhance your enjoyment of the home, you may not recoup the full investment when it comes time to sell.

- Appraisal and Buyer Perception: When you decide to sell your home, an appraiser will assess its value, taking into account recent renovations and market conditions. Additionally, buyers' perception of the improvements and their willingness to pay a higher price can also affect the realized value.

How to apply for a home improvement loan

Here's a step-by-step guide on how to apply for a home improvement loan, with unique language:

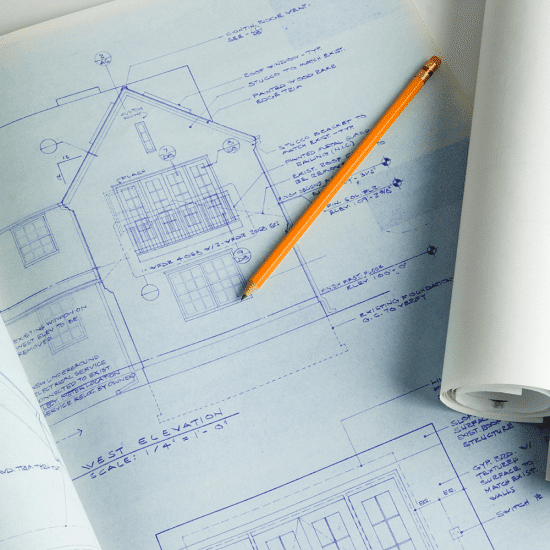

- Assess Your Renovation Needs: Start by evaluating your home improvement needs. Determine the scope of the project, create a detailed budget, and gather estimates from contractors or suppliers to establish the loan amount you will require.

- Research Lenders and Loan Options: Explore different lenders and loan options to find the one that best suits your needs. Look for reputable lenders who offer home improvement loans with favorable terms, such as competitive interest rates, flexible repayment options, and reasonable fees.

- Check Eligibility Requirements: Review the eligibility criteria for each lender and loan product. Take note of factors such as minimum credit score requirements, income qualifications, and any specific documentation they may require for the application process.

- Gather Required Documents: Collect the necessary documents to support your loan application. Common documents may include proof of income, recent tax returns, bank statements, identification, and details about the planned home improvement project.

- Obtain Loan Pre-Approval: Consider seeking pre-approval for a home improvement loan. This involves submitting your application and supporting documents to the lender, who will assess your financial information and provide an estimate of the loan amount you may qualify for.

- Submit Your Loan Application: Complete the loan application form provided by the lender. Provide accurate and thorough information about your personal and financial details, including the loan amount, purpose of the loan, and the specifics of your home improvement project.

- Await Loan Approval and Review Terms: After submitting your application, wait for the lender's decision. Once approved, carefully review the loan terms, including the interest rate, repayment period, monthly payment amount, and any associated fees. Ensure you fully understand the terms before proceeding.

- Accept the Loan Offer and Close the Loan: If satisfied with the loan terms, accept the offer by signing the loan agreement. The lender may require additional documentation or information during this stage. After completing any necessary paperwork, the loan will be finalized, and the funds will be disbursed to you.

- Begin Your Home Improvement Project: Once the loan is disbursed, you can start your home improvement project. Hire reputable contractors, purchase necessary materials, and oversee the renovation process. Keep track of expenses and ensure the funds are used for their intended purpose.

Find Your Best Rate

Compare Best Personal Loans

Personal Loan Payoff Calculator

Personal Loan Lender Reviews

Personal Loans By Credit

Personal Loans for Fair Credit

Personal Loans for Good Credit

Personal Loans for Excellent Credit

Personal Loan Types

Auto Repair Loans

Credit Card Consolidation Loans

Fast Personal Loans

Home Improvement Loans

Horse Barn Financing

Wedding Loans

Family Planning Loans

Funeral Financing

Land Purchase Financing

Manufactured Home Financing

Medical Loans

Cosmetic & Plastic Surgery Financing

Owner Builder Construction Loans

Personal Loans for House Down Payment

Personal Loans for Self Employed

Personal Loans for Furniture Expenses

Student Loans

Debt Consolidation Loans

Vacation & Travel Loans

Emergency Personal Loans

Personal Loans with Co-signers

Home Improvement Financing

Appliance Financing

Bathroom Remodel Financing

Basement Remodel Financing

Boat Dock Loans

Deck Financing

Driveway Paving Financing

Fence Financing

Flooring Financing

Furnace Financing

Garage Financing

Home Addition Financing

Hot Tub Financing

HVAC Financing

Home Insulation Financing

Interior & Exterior Painting Financing

Kitchen Remodel Financing

Kitchen Cabinet Financing

Pole Barn Financing

Roof Financing

Solar Panel Financing

Swimming Pool Financing

Sunroom Addition Loans

Window Replacement Financing

Loan rate & terms disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.