Liposuction Financing Options

Get pre-qualified for a personal loan in just minutes. Checking rates won’t affect your credit score

How to Get a Loan for a Liposuction Weight Loss Surgery

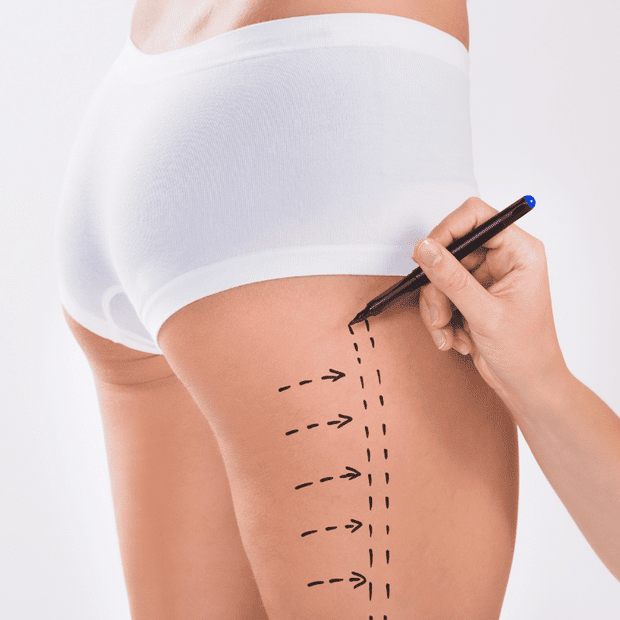

All of us struggle with our weight at one time or another, especially as we grow older and our metabolisms start to slow. This can lead us to feel like we are constantly battling with our desire to live and our desire to lose weight, and so choosing liposuction can be a good way to reset and achieve fast results. Liposuction should never be done on a budget, and so you may need to seek liposuction financing to fund your procedure.

Applying for liposuction financing is fast and easy:

Compare personal loan rates

Compare personal loan rates in July, 2025

Can liposuction be financed?

Yes, liposuction can be financed in many cases. Financing options are commonly available for cosmetic procedures like liposuction to help individuals manage the cost of the surgery.

What is liposuction financing?

Liposuction financing refers to the process of obtaining financial assistance or a loan specifically to cover the cost of liposuction surgery. Liposuction is a cosmetic procedure that involves the removal of excess fat deposits from specific areas of the body. Since liposuction is typically an elective procedure and not covered by health insurance, financing options are often sought to help individuals manage the expenses associated with the surgery.

How does liposuction financing work?

Liposuction financing works by providing individuals with the financial means to cover the cost of liposuction surgery through various financing options.

How much does liposuction cost?

The cost of liposuction can vary significantly depending on various factors, including the geographical location, the surgeon's expertise, the extent of the procedure, the number of areas being treated, and the clinic or facility where the surgery is performed. Additionally, additional costs such as anesthesia fees, facility fees, and post-operative garments may also be involved.

To provide you with a general idea, the cost of liposuction typically ranges from $2,000 to $10,000 or more. However, it's important to note that this is just an estimated range, and the actual cost can vary widely.

Types of liposuction procedures

There are several different types of liposuction techniques available, each with its own unique approach and variations. Here are some of the commonly used types of liposuction:

- Traditional Liposuction: Traditional liposuction, also known as suction-assisted liposuction (SAL), involves the use of a cannula (a thin tube) connected to a vacuum device. The surgeon manually inserts the cannula through small incisions and uses back-and-forth movements to break up and suction out the excess fat.

- Tumescent Liposuction: Tumescent liposuction is a technique that involves injecting a solution into the targeted area before the fat removal process. The solution typically contains a local anesthetic to numb the area, a vasoconstrictor to reduce bleeding, and a saline solution to facilitate fat removal. The tumescent technique can help minimize blood loss and provide additional comfort during and after the procedure.

- Power-Assisted Liposuction (PAL): Power-assisted liposuction utilizes a specialized cannula that vibrates or oscillates, helping the surgeon dislodge fat cells more easily. The mechanical movements of the cannula assist in breaking up the fat, making it easier to remove. PAL can potentially reduce the physical strain on the surgeon and improve the precision of fat removal.

- Ultrasound-Assisted Liposuction (UAL): Ultrasound-assisted liposuction involves the use of ultrasonic energy to liquefy the fat cells before their removal. A specialized cannula emits ultrasonic waves that target and break down the fat cells. The liquefied fat is then suctioned out through the cannula. UAL is particularly effective in treating areas with dense fat deposits, such as the back or male breast tissue (gynecomastia).

- Laser-Assisted Liposuction (LAL): Laser-assisted liposuction utilizes laser energy to liquefy the fat cells, making them easier to remove. The surgeon inserts a laser fiber through small incisions and delivers laser energy to the fat cells, causing them to break down. The liquefied fat is then suctioned out. LAL techniques can also promote skin tightening by stimulating collagen production.

Can you do payment plans on liposuction?

Whether or not your cosmetic surgeon provides payment plans will depend on the practice in question, but you can get the benefits of a payment plan with a personal loan through a bank or alternative lender. In fact, most payment plans provided by plastic surgeons are a form of personal loan provided through a partner lender.

What are the costs associated with liposuction?

The costs associated with liposuction typically include the following:

- Surgeon's Fees: This covers the fee charged by the plastic surgeon for performing the liposuction procedure. The surgeon's fee is influenced by their experience, expertise, and reputation.

- Anesthesia Fees: Liposuction is usually performed under either local anesthesia (with sedation) or general anesthesia. Anesthesia fees cover the cost of the anesthesiologist or nurse anesthetist administering and monitoring anesthesia during the surgery.

- Facility Fees: These fees include the cost of using the surgical facility, including operating room fees, equipment, and staff assistance. The fees can vary depending on the location and quality of the facility.

- Pre-operative Tests: Prior to the liposuction procedure, your surgeon may require certain medical tests or laboratory work, such as blood tests or ECG, to ensure your overall health and safety. These tests may have associated costs.

- Post-operative Garments: After liposuction, specialized compression garments are often recommended to be worn to aid in the healing process and help with swelling and contouring. The cost of these garments should be considered as part of the overall expense.

Does insurance cover liposuction?

In general, liposuction is considered a cosmetic procedure and is not typically covered by health insurance. Cosmetic surgeries, including liposuction, are elective procedures performed for aesthetic purposes rather than medical necessity. As a result, insurance companies do not typically provide coverage for the cost of liposuction.

What kind of results can I expect from liposuction?

Speak to your surgeon during your consultation to find out what results you can expect personally, but most people drop a significant amount of weight and see the full results 1-3 months after the procedure, once the body has time to recover. Most people experience long-lasting results, provided they keep up a healthy lifestyle.

How can I finance a liposuction procedure?

Here are the most popular options for financing liposuction:

- Savings & Investments: Paying for elective procedures via your savings or easily liquidated investments will always be the most affordable way to finance your liposuction. You won’t incur any interest or additional fees and won’t need to worry about budgeting for monthly payments. Instead, you can use that money to repay yourself and replenish your savings.

- Personal Loans: Personal loans are the most popular form of financing for liposuction as you receive the lump sum and can then use it to pay for your procedure as you please. How much you’ll be able to borrow will depend on your income and creditworthiness.

- 0% APR Credit Cards: If you can get a card with a higher credit limit or simply have an excellent credit score and some savings to use for your procedure, you can consider a 0% APR credit card. These cards offer 0% interest periods for between 3-21 months so can be a good way to spread the cost of some of your procedure. A low-interest credit card is another good option.

- HELOC: A Home Equity Line of Credit works much like a credit card, in that you are given a credit limit and can borrow as you please up to that amount. The difference is that it acts more like a bank account than a card and it is secured by your home’s equity. This means you can get higher limits with lower rates, but if you default your home will be at risk of being seized.

- 401(k) Loan: If you have a 401(k) retirement plan that allows loans, you can take out a loan from your future retirement finances to pay for your procedure. This must be paid back within 5 years and there may be other strict rules about how you must pay this back, so do your research, but they don’t require a credit check or interest.

- In-House Financing: Most cosmetic surgeons offer some form of in-house financing, often provided through a partner lender. This will provide you with a payment plan, but be aware that in most cases it is actually a personal loan, so make sure you compare the terms with what you could get via an external lender.

Compare Offers

Ready to find the best loan for cosmetics & plastic surgery procedures? Get started!

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

How Pasha Funding Works

Pros & Cons of Liposuction Financing

PROS

- Get liposuction now, rather than having to save up

- Keep your savings (so you have a good buffer)

- Spread the cost

- Many options offer low-interest rates for those with good or excellent credit

CONS

- Stretching yourself financially to afford the procedure can lead you to struggle to get credit until the loan is paid off

- Financing options quickly get expensive if you have mediocre or bad credit

What credit score do you need to obtain liposuction financing?

The credit score requirements for liposuction financing can vary depending on the lender or financing company you choose. Different financing options may have different criteria and minimum credit score requirements. In general, lenders prefer borrowers with good to excellent credit scores to minimize the risk of default.

Can I get liposuction financing with bad credit?

While it may be possible, it’s usually not advisable to do so. You’ll find that most of the options available to those with bad credit have extremely high interest rates which will make the procedure unnecessarily costly and the monthly payments unaffordable. Make sure you’re realistic about what you can comfortably afford.]

How to qualify for liposuction financing

Qualifying for liposuction financing typically involves meeting certain criteria set by the lender or financing company. While specific requirements may vary, here are some common factors that can help you qualify for liposuction financing:

- Good Credit Score: Having a good credit score improves your chances of qualifying for financing and obtaining favorable terms. Lenders typically prefer borrowers with higher credit scores, as it demonstrates responsible credit management. Aim for a credit score of 700 or above to increase your chances of approval.

- Stable Income: Lenders want assurance that you have a stable source of income to repay the financing. A steady job or a consistent income stream can enhance your eligibility. Be prepared to provide proof of income, such as pay stubs or tax returns, to demonstrate your financial stability.

- Low Debt-to-Income Ratio: Lenders evaluate your debt-to-income ratio, which compares your monthly debt obligations to your monthly income. A lower ratio indicates better financial health and a higher likelihood of repayment. Aim to keep your debt-to-income ratio below 40% to improve your qualification chances.

- Employment History: Having a stable employment history can boost your eligibility for financing. Lenders may consider your work history to assess your stability and ability to meet financial obligations. Consistent employment demonstrates reliability and reduces the perceived risk for lenders.

- Responsible Financial Management: Lenders may assess your overall financial management skills and responsible borrowing behavior. Maintaining a positive payment history, avoiding late payments or defaults, and having a good track record with other lenders can increase your chances of qualifying for financing.

- Adequate Collateral or Guarantor (if applicable): Depending on the financing option, you may need to provide collateral or have a guarantor who can take responsibility for the debt in case of default. This requirement varies among lenders, so be sure to inquire about it if relevant.

Cosmetic Financing Options

Breast

Body Lift

Male

Fat Reduction

Face & Neck

Personal Loans for Every Occasion

Find Your Best Rate

Compare Best Personal Loans

Personal Loan Payoff Calculator

Personal Loan Lender Reviews

Personal Loans By Credit

Personal Loans for Fair Credit

Personal Loans for Good Credit

Personal Loans for Excellent Credit

Personal Loan Types

Auto Repair Loans

Credit Card Consolidation Loans

Fast Personal Loans

Home Improvement Loans

Horse Barn Financing

Wedding Loans

Family Planning Loans

Funeral Financing

Land Purchase Financing

Manufactured Home Financing

Medical Loans

Cosmetic & Plastic Surgery Financing

Owner Builder Construction Loans

Personal Loans for House Down Payment

Personal Loans for Self Employed

Personal Loans for Furniture Expenses

Student Loans

Debt Consolidation Loans

Vacation & Travel Loans

Emergency Personal Loans

Personal Loans with Co-signers

Home Improvement Financing

Appliance Financing

Bathroom Remodel Financing

Basement Remodel Financing

Boat Dock Loans

Deck Financing

Driveway Paving Financing

Fence Financing

Flooring Financing

Furnace Financing

Garage Financing

Home Addition Financing

Hot Tub Financing

HVAC Financing

Home Insulation Financing

Interior & Exterior Painting Financing

Kitchen Remodel Financing

Kitchen Cabinet Financing

Pole Barn Financing

Roof Financing

Solar Panel Financing

Swimming Pool Financing

Sunroom Addition Loans

Window Replacement Financing

Loan rate & terms disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.