Pole Barn Financing

Get pre-qualified for a pole barn loan in just minutes. Checking rates won’t affect your credit score

How to Get a Pole Barn Loan

Pole barns make a fantastic addition to homes and businesses for various reasons. For some, they provide storage for livestock or large equipment, while others use them as a storefront for their agricultural business. Pole barns can even be used for other residential purposes, such as greenhouses!

While pole barns offer an affordable option, thanks to their relatively economical design, they often require financing to create. Therefore, knowing your financing options is essential when planning to add a pole barn to your residential or commercial spaces.

Applying for a pole barn loan is fast and easy:

How Pasha Funding Works

Compare personal loan rates

Compare personal loan rates in June, 2025

What are pole barns?

Essentially, a pole barn is a building created with post-frame construction. Poles are fastened above ground or pushed into the ground. Unlike standard stud-wall dwellings, where the walls support the roof, the poles support the roofing.

What are pole barns used for?

Pole barns are post-frame structures that can be built in various ways. Some individuals and companies have a rustic country image, while others resemble more complex or traditional structures. Typical residential uses for pole barns include garages, guest homes, or simply additional spaces to your current residence. They've been converted into schools, churches, gymnasiums, and hockey rinks, among other things - so the possibilities are truly endless.

How much does a pole barn cost?

he cost of a pole barn can vary depending on several factors such as the size, materials used, location, and additional features. While I can provide you with some general information, it's important to note that prices can fluctuate over time and may vary based on specific circumstances. Here are some estimated costs based on trusted sources:

HomeAdvisor provides an average cost range for pole barns between $4,000 and $50,000, with the national average falling around $18,000. This range is for a basic structure without any additional features or finishes. You can find more information at:

What is pole barn financing?

Pole barn financing refers to the various options available to individuals or businesses to obtain financial assistance for building a pole barn. It is a means of securing funds to cover the expenses associated with constructing a pole barn, which can include materials, labor, permits, and other related costs.

How does pole barn financing work?

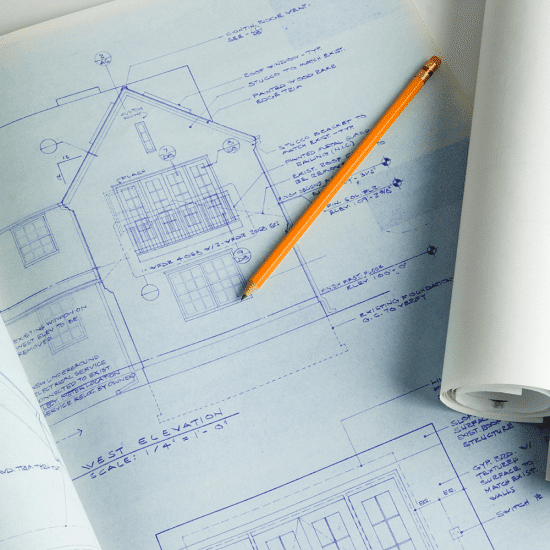

Pole barn financing, fortunately, operates in the same way as any other loan; all you have to do is select the best lender for your circumstances. Ask the building company you plan to work with to draw out the expenses, drawings, or quote for the build before you seek financing. This way, you'll be able to demonstrate to your lender how much the project will cost and how much money you'll need to borrow. Although all pole barn financing alternatives don't require it, it is a valuable document to have on hand, especially if you're building for commercial purposes.

Pole barn financing options

There are several financing options available for your pole barn project, each with its own characteristics. Here are additional options to consider:

Construction Loan: A construction loan is specifically designed for financing building projects. It provides funds in stages as the construction progresses. Once the construction is complete, the loan can be converted into a traditional mortgage or refinanced. These loans typically have variable interest rates during the construction phase and transition to a fixed rate once the project is finished.

Personal Loans: A personal loan may be the ideal alternative if you have a good or excellent credit score. These loans are usually unsecured, meaning they lend to you based on your creditworthiness and can't take your home or other valuables if you don't pay them back.

Home Equity Loan: Similar to a HELOC, a home equity loan allows you to borrow against the equity in your home. With a home equity loan, you receive a lump sum of money that you can use for your pole barn construction. The interest rates are typically fixed, and the loan is repaid over a set term.

Government Programs: Depending on your location and specific circumstances, there may be government programs available that offer financing options for agricultural or rural projects. These programs can provide low-interest loans or grants for agricultural-related structures like pole barns. Researching local or regional agricultural agencies can help you identify potential programs.

Personal Savings or Investments: If you have substantial personal savings or investments, you may consider using those funds to finance your pole barn project. This option allows you to avoid interest charges and potential debt. However, it's important to consider the opportunity cost of using those funds and whether it aligns with your financial goals.

Vendor Financing: Some pole barn suppliers or contractors may offer financing options directly. They may have partnerships with lenders or provide in-house financing arrangements. It's worth inquiring with your chosen supplier or contractor to explore any financing options they may offer.

Quick links

Ready to apply for a pole barn loan? Get started.

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

Pros & cons of pole barn financing

PROS

- Access to Funds: Financing allows you to access the funds needed to build a pole barn without requiring immediate payment in full, making it more affordable for many people.

- Flexibility: Various financing options provide flexibility in terms of repayment schedules, allowing you to choose a plan that fits your budget and financial situation.

- Preserving Cash Flow: Financing enables you to preserve your cash flow by spreading out the cost of the pole barn over time, making it easier to manage other financial obligations.

- Opportunity for Upscaling: With financing, you may have the opportunity to build a larger or more advanced pole barn than you would be able to afford with upfront payment alone.

- Potential Tax Benefits: Depending on your location and circumstances, you may be eligible for tax benefits or deductions related to the financing of a pole barn.

CONS

- Interest Charges: Financing involves paying interest on the borrowed amount, increasing the overall cost of the pole barn project.

- Debt Obligation: Taking on a loan means you have a financial obligation to repay the borrowed amount, which may limit your financial flexibility until the loan is fully paid off.

- Approval Process: Some financing options may require a credit check and approval process, which could potentially result in higher interest rates or a denial of the loan application for individuals with poor credit history.

- Collateral or Risk: Certain financing options, such as secured loans or home equity loans, may require collateral, putting your property at risk if you are unable to make the payments as agreed.

- Potential Long-Term Commitment: Depending on the financing option you choose, you may be committed to making monthly payments for an extended period, potentially affecting your financial plans and future obligations.

How much does it cost to insulate a pole barn?

The cost of insulating a pole barn can vary depending on various factors such as the size of the barn, the type of insulation used, labor costs, and regional pricing differences. While I can provide you with a general idea, it's important to note that prices can fluctuate over time and may vary based on specific circumstances. Here is an estimate based on a trusted source:

According to HomeAdvisor, the average cost to insulate a pole barn ranges from $1 to $5 per square foot. This estimate includes the cost of insulation materials and the labor involved in the installation. The total cost can increase if additional features such as vapor barriers, radiant barriers, or air sealing are required.

Can you live in a pole barn?

Yes, you can! A pole barn home isn't necessarily a novel concept. While pole barns are typically used for animals or machines, their dependable construction makes them an excellent shelter for people as well! However, it is essential to consider the extra steps you will need to take to ensure that your pole barn is up to code as a residential living space.

Do banks offer financing for pole barns?

Yes, in some situations, but not with a standard loan. You can use the pole barn financing methods outlined above to build a pole barn home, but you'll probably be unable to secure a mortgage as pole barns are not a standard structure.

What kind of interest can I expect to pay on a pole barn loan?

The interest rate you can expect to pay on a pole barn loan varies based on factors like your creditworthiness, the type of loan, and current market conditions. Personal loan interest rates generally range from 6% to 36%, while construction loan rates can be around 4% to 12% or higher. Home equity loans and HELOCs often offer lower rates tied to the prime rate plus a margin. It's best to consult with lenders to get personalized quotes based on your situation.

Pole Barn Financing Calculator

Total Payment

-

Total Interest

-

Monthly Payment

-

Ready to apply for a personal loan?

Compare rates from top lenders with no impact on your credit, ever.

What minimum credit score do I need to qualify for a pole barn loan?

While each lender and loan type has unique requirements, there is a typical range concerning personal financing. As a rule of thumb, lenders seek a credit score between 610 and 640 as a minimum admission requirement. The more competitive your credit score and the lower your debt-to-income ratio, the more likely you will be approved for the loan and earn the lowest possible interest rate.

How to apply for a pole barn loan

- Research and Compare Lenders: Begin by thoroughly researching and comparing various lenders that specialize in pole barn financing. Look for reputable lenders with positive customer reviews and competitive loan terms.

- Visit Lender Websites: Explore the websites of the selected lenders to gather detailed information about their loan products and application process. Familiarize yourself with their specific requirements and offerings.

- Gather Required Documents: Before starting the online application, gather all the necessary documents typically required by lenders. This may include identification documents, proof of income, bank statements, and any other relevant financial information.

- Complete the Online Application: Access the lender's secure online application portal and provide accurate information in the required fields. Be prepared to share personal details, employment information, income verification, and the purpose of the loan—specifically, the construction of a pole barn.

- Submit Supporting Documents: Some lenders may request additional documents to support your application. Scan or upload these documents securely through the lender's online portal as instructed.

- Review and Accept Loan Terms: Carefully review the loan terms, including interest rates, repayment period, and associated fees. Make sure you understand and agree to all the terms before accepting the loan offer.

- Loan Approval and Disbursement: Once your application has been evaluated, the lender will determine your eligibility and make a loan offer. If approved, carefully review the offer and, if satisfactory, accept it. The lender will then initiate the disbursement process to transfer the loan funds to your designated bank account.

Compare personal loans from top lenders

Are you ready to find a personal loan for your needs? We've partnered with Credible to help you find your rate. Checking your score is free and won't impact your credit!

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

Find Your Best Rate

Compare Best Personal Loans

Personal Loan Payoff Calculator

Personal Loan Lender Reviews

Personal Loans By Credit

Personal Loans for Fair Credit

Personal Loans for Good Credit

Personal Loans for Excellent Credit

Personal Loan Types

Auto Repair Loans

Credit Card Consolidation Loans

Fast Personal Loans

Home Improvement Loans

Horse Barn Financing

Wedding Loans

Family Planning Loans

Funeral Financing

Land Purchase Financing

Manufactured Home Financing

Medical Loans

Cosmetic & Plastic Surgery Financing

Owner Builder Construction Loans

Personal Loans for House Down Payment

Personal Loans for Self Employed

Personal Loans for Furniture Expenses

Student Loans

Debt Consolidation Loans

Vacation & Travel Loans

Emergency Personal Loans

Personal Loans with Co-signers

Home Improvement Financing

Appliance Financing

Bathroom Remodel Financing

Basement Remodel Financing

Boat Dock Loans

Deck Financing

Driveway Paving Financing

Fence Financing

Flooring Financing

Furnace Financing

Garage Financing

Home Addition Financing

Hot Tub Financing

HVAC Financing

Home Insulation Financing

Interior & Exterior Painting Financing

Kitchen Remodel Financing

Kitchen Cabinet Financing

Pole Barn Financing

Roof Financing

Solar Panel Financing

Swimming Pool Financing

Sunroom Addition Loans

Window Replacement Financing

Loan rate & terms disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.