Garage Financing

Get pre-qualified for a garage loan in just minutes. Checking rates won’t affect your credit score

Loans to Build a Detached Garage

Garage financing is a type of loan that can be used to finance the construction, renovation, or repair of a garage. Garage loans can be obtained from banks, credit unions, and online lenders. The interest rates and terms of garage financing vary depending on the lender and the borrower's credit score.

Applying for a garage loan is simple:

How Pasha Funding Works

Compare personal loan rates

Compare personal loan rates in July, 2025

How to finance a detached garage

There are a few different ways to finance a garage, each with its own advantages and disadvantages. Here are some of the most common options:

- Personal loan: A personal loan is a type of unsecured loan that can be used for any purpose, including financing a garage. Personal loans typically have lower interest rates than credit cards, and they can be repaid over a longer period of time, making them a good option for people who need to spread out the cost of a garage.

- In-house financing: Many garage companies offer financing through a partner lender. This can be a convenient option, as you can get all of your financing through one company. However, it's important to compare the terms of the in-house financing to what you could get from an independent lender.

- Home equity line of credit (HELOC): A HELOC is a type of revolving credit that is secured by your home equity. This means that the lender can take your home if you default on the loan. HELOCs typically have lower interest rates than personal loans, and they can be a good option if you need access to funds for a variety of purposes.

- Home equity loan: A home equity loan is a type of fixed-rate loan that is secured by your home equity. Home equity loans typically have higher interest rates than HELOCs, but they can be a good option if you know how much you need to borrow and you want a fixed monthly payment.

- Cash-out refinance: A cash-out refinance is a type of mortgage refinance where you take out a new mortgage that is larger than your current mortgage. The extra money that you borrow can be used for any purpose, including financing a garage. Cash-out refinances typically have higher interest rates than traditional mortgages, but they can be a good option if you have good credit and you want to access a large amount of cash.

- 401(k) loan: A 401(k) loan is a type of loan that allows you to borrow money from your 401(k) account. 401(k) loans typically have lower interest rates than personal loans, but there are some restrictions on how you can use the money.

The best way to finance a garage will depend on your individual circumstances. Consider your budget, your credit score, and your purpose for financing a garage when choosing an option.

Are there alternatives to garage financing?

There are a few alternatives to garage loan options if you are looking to finance the construction or renovation of a garage. Here are a few options:

- Saving up: This is the most obvious option, but it can take time and effort. If you are able to save up enough money, you will not have to worry about paying interest on a loan.

- Using a credit card: If you have a credit card with a 0% APR introductory offer on balance transfers, you can use this to finance the cost of a garage. However, you will need to be able to pay off the balance before the introductory offer expires, or you will be charged interest on the entire balance.

- Asking for a gift or loan from family or friends: This can be a good option if you have close friends or family members who are willing to help you out. However, it is important to make sure that you can repay the loan on time and in full.

The best option for you will depend on your individual circumstances. It is important to shop around and compare rates from different lenders before you choose a financing option.

Do garages increase property values?

Yes, garages can increase property values. According to a report published by Remodeling Magazine, which conducts an annual "Cost vs. Value" analysis, adding a garage to a home consistently ranks as one of the home improvement projects that yield a high return on investment (ROI). The report estimates the average ROI for a garage addition to be around 62.8% nationally.

Types of garages

- Detached garage: This is the most common type of garage. It is a separate structure from your home, and it is typically made of wood, metal, or concrete. Detached garages can be custom-built to match the exterior of your home, or they can be purchased as prefabricated kits.

- Prefab garage: This is another name for a “garage kit.” Prefab garages are prefabricated structures that are shipped to your home and then assembled on-site. Prefab garages are a good option if you are on a budget, or if you want to save time on the construction process.

- Attached garage: An attached garage is a garage that is attached to your home. Attached garages are typically more expensive than detached garages, but they can also add value to your home. Attached garages can be a good option if you want to maximize your living space, or if you want to have easy access to your car from inside your home.

- Portico garage: A portico garage is a detached garage that is connected to your home by a covered walkway. Portico garages are a good option if you want the convenience of an attached garage without the cost. Portico garages can also provide additional storage space.

- Barn garage: A barn garage is a type of garage that is made of wood and has a loft. Barn garages are a good option if you want a garage that is both functional and stylish. Barn garages can also provide additional storage space.

- Carport: A carport is a covered structure that is used to park cars. Carports are a less expensive option than garages, and they can be a good option if you live in a warm climate. Carports do not provide as much protection from the elements as garages, but they can still be a convenient way to park your car.

Is it cheaper to build or buy a garage?

When comparing the cost of building versus buying a garage, it can vary depending on several factors, such as location, size, materials used, and individual preferences. While I can provide an opinion, it's important to consider your specific circumstances. Here are a few points to consider:

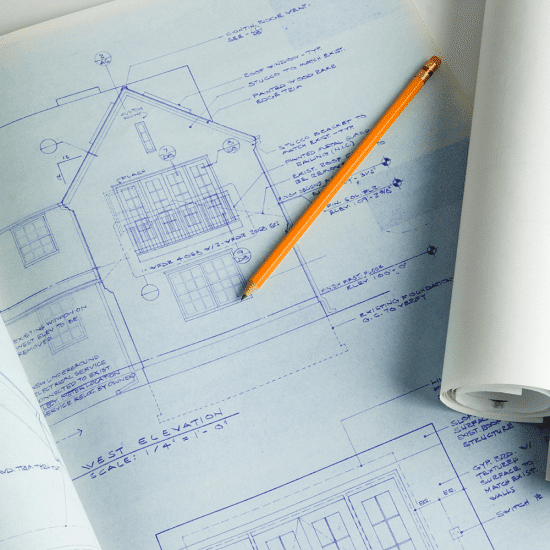

Building a Garage: Building a garage from scratch allows for customization and the ability to tailor the design to your specific needs. This level of flexibility can be advantageous, especially if you have unique requirements or want to match the aesthetic of your home. However, building a garage requires more time, effort, and often involves hiring contractors or construction professionals. The cost of materials, labor, permits, and any unexpected expenses should be taken into account.

Buying a Garage: Purchasing a pre-fabricated or pre-built garage can offer convenience and potentially save time compared to building one from scratch. These ready-made garages typically come in standard sizes and designs, which may limit customization options. However, they can be more cost-effective in terms of upfront expenses, as the price often includes materials, labor, and delivery. Additionally, buying a pre-built garage may require less involvement in the construction process and minimize the need for hiring contractors.

How much does it cost to build a 20 x 20 garage?

The cost to build a 20 x 20 garage will vary depending on the location, the materials used, and the labor costs in your area. However, you can expect to pay between $20,000 and $40,000 for a basic 20 x 20 garage.

Here is a breakdown of the costs involved in building a 20 x 20 garage:

- Materials: The cost of materials will vary depending on the type of materials you choose. For example, a metal garage will be less expensive than a brick garage.

- Labor: The cost of labor will also vary depending on the location and the time of year. In general, labor costs are higher in urban areas and during the summer months.

- Other costs: Other costs that you may need to consider include permits, excavation, and foundation work.

How much does garage financing cost?

Below is a sample table of what you might expect to pay on a new garage build using various interest rates. Use our calculator below to further estimate your payments:

| Loan Amount | Interest Rate | Repayment Term (Years) | Monthly Payment | Total Interest Paid | Total Cost of Loan |

|---|---|---|---|---|---|

| $15,000 | 5.00% | 5 | $318.05 | $2,382.77 | $17,382.77 |

| $15,000 | 5.00% | 10 | $159.03 | $4,765.55 | $19,765.55 |

| $15,000 | 5.00% | 15 | $106.02 | $7,951.32 | $22,951.32 |

| $15,000 | 7.50% | 5 | $335.29 | $3,108.26 | $18,108.26 |

| $15,000 | 7.50% | 10 | $172.65 | $6,555.22 | $21,555.22 |

| $15,000 | 7.50% | 15 | $114.74 | $10,759.48 | $25,759.48 |

| $25,000 | 5.00% | 5 | $529.41 | $4,007.90 | $29,007.90 |

| $25,000 | 5.00% | 10 | $265.05 | $8,251.75 | $33,251.75 |

| $25,000 | 5.00% | 15 | $176.70 | $13,256.50 | $38,256.50 |

| $25,000 | 7.50% | 5 | $562.82 | $4,810.68 | $29,810.68 |

| $25,000 | 7.50% | 10 | $281.41 | $10,387.89 | $35,387.89 |

| $25,000 | 7.50% | 15 | $187.91 | $15,908.73 | $40,908.73 |

New Garage Financing Calculator

Total Payment

-

Total Interest

-

Monthly Payment

-

Ready to apply for a personal loan?

Compare rates from top lenders with no impact on your credit, ever.

Quick links

Ready to apply for a garage loan? Get started.

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

What’s the best way to finance a metal garage?

Metal garages are one of the best options if you want something simple and aren’t worried about what temperature it is inside the garage (since they get very cold in winter and very hot in summer). Because they are not the most visually appealing or comfortable to use, they are usually cheap to buy and install - you can find one for $1,000 - $3,000 for one car. If you’re thinking of buying one of these garages, you may be able to finance your purchase with a credit card. Try to get a card with a low interest rate, 0% APR rate, or a good introductory offer to make the most of this option.

What is the cheapest way to build a garage?

The cheapest way to build a garage can vary depending on several factors, including location, size, materials used, and your level of involvement in the construction process. Here are a few strategies that can help reduce costs:

- DIY Construction: Building a garage yourself can potentially save money on labor costs. If you have the necessary skills, knowledge, and time, you can take on various aspects of the construction process, such as foundation preparation, framing, and finishing. However, keep in mind that certain tasks, such as electrical and plumbing work, may require professional assistance.

- Basic Design and Materials: Opting for a simple and straightforward garage design can help minimize costs. Avoiding complex architectural features, unnecessary additions, or excessive customization can keep expenses down. Additionally, choosing cost-effective materials that meet your needs, such as basic metal siding or prefabricated components, can help reduce construction expenses.

- Size Considerations: Building a smaller garage will generally cost less than constructing a larger one. Assess your needs and consider the minimum size that will fulfill your requirements. Remember to factor in space for vehicles, storage, and any additional functionalities you desire.

- Shop Around for Materials and Contractors: Take the time to shop around and compare prices for construction materials, including lumber, roofing, doors, and windows. Request quotes from multiple suppliers or contractors to ensure you are getting the best possible deal. However, be cautious of extremely low-cost options, as they may compromise quality or reliability.

- Obtain Permits and Plan Ahead: Research and obtain the necessary permits and approvals before starting construction. Failure to comply with local regulations can result in fines and additional expenses. Planning the project thoroughly and avoiding changes or delays during construction can also help prevent unnecessary costs.

What are the pros and cons of garage financing?

Pros of Garage Financing

- Improves property value: A garage can add value to your home, both in terms of its resale value and its current market value.

- Increases convenience: A garage can provide you with a convenient place to park your car, store your belongings, and work on projects.

- Spreads out the cost: Garage financing can allow you to spread out the cost of building or renovating a garage over time, making it more affordable.

Cons of Garage Financing

- Takes on debt: Garage financing is a form of debt, so you will need to be able to afford the monthly payments.

- May not recoup your investment: If you sell your home, you may not recoup the money you spent on the garage.

- Interest rates can be high: The interest rates on garage loans can be high, so you will need to shop around and compare rates before you take out a loan.

What credit score do you need to obtain a garage loan?

The credit score required for garage financing can vary depending on the lender and the specific financing option you choose. Different lenders have different criteria and may have varying minimum credit score requirements. Generally, a higher credit score increases your chances of being approved for favorable financing terms. While I can provide some general guidelines, it's important to note that credit score requirements can vary, and individual lenders may have their own specific criteria.

In general, a credit score in the range of 660 to 680 or higher is often considered good and may qualify you for competitive financing options. However, some lenders may be willing to work with borrowers who have lower credit scores or offer alternative financing options for individuals with less-than-perfect credit.

Can you get garage financing with bad credit?

Yes, you can get garage financing with bad credit. However, it may be more difficult and you may have to pay higher interest rates. There are a few different lenders that offer garage financing to borrowers with bad credit. Some of these lenders include:

- Home improvement loans: These loans are specifically designed to finance home improvement projects, including garages. Home improvement loans typically have higher interest rates than other types of loans, but they may be a good option for borrowers with bad credit.

- Personal loans: Personal loans can be used to finance a variety of purposes, including garages. Personal loans typically have lower interest rates than home improvement loans, but they may be more difficult to qualify for with bad credit.

- Credit cards: Some credit cards offer 0% APR introductory offers on balance transfers. This can be a good way to finance a garage if you have bad credit and you can transfer the balance to a credit card with a 0% APR introductory offer.

If you are considering garage financing with bad credit, it is important to shop around and compare rates from different lenders. You should also be prepared to provide documentation of your income and assets.

How long will it take to obtain a loan for a garage build?

The time it takes to obtain a loan for a garage build can vary depending on a number of factors, including the lender, the amount of the loan, and the borrower's credit score. However, in general, it can take anywhere from a few weeks to a few months to finalize a loan.

Here are some of the factors that can affect the time it takes to obtain a loan for a garage build:

- Lender: Some lenders are faster than others when it comes to processing loan applications.

- Amount of the loan: Larger loans typically take longer to process than smaller loans.

- Borrower's credit score: Borrowers with good credit scores typically get approved for loans more quickly than borrowers with bad credit scores.

- Documentation: Lenders will need to see proof of income, assets, and other documentation before they can approve a loan.

If you are considering financing a garage build, it is a good idea to start the process early. This will give you enough time to get pre-approved for a loan and to find a contractor who can start construction.

What are the repayment terms for garage loans?

Repayment terms for personal loans vary by lender but typically range from a few years to several years. The specific term will depend on the loan amount, interest rate, and your agreement with the lender.

How to finance your garage build

To apply for garage financing, follow these steps:

- Research Lenders: Look for lenders that offer financing options specifically for garages or home improvement projects.

- Check Eligibility Criteria: Review the lender's eligibility requirements, such as minimum credit score, income criteria, and any other specific qualifications.

- Gather Documentation: Prepare the necessary documents, including identification, proof of income, employment history, and other requested paperwork.

- Complete the Application: Fill out the lender's application form accurately and provide the required information.

- Submit the Application: Submit your completed application along with the required documentation either online, in person, or by mail, following the lender's instructions.

- Await Approval: The lender will review your application and assess your eligibility. This process may take a few days to a couple of weeks, depending on the lender.

- Review and Accept Loan Terms: If approved, carefully review the loan terms, including interest rate, repayment schedule, and any associated fees. Ensure you understand the terms before accepting the offer.

- Receive Funds: Once you accept the loan offer, the lender will finalize the process, and the funds will be disbursed to you. The timeline for receiving the funds varies among lenders.

Compare personal loans from top lenders

Are you ready to find a personal loan for your needs? We've partnered with Credible to help you find your rate. Checking your score is free and won't impact your credit!

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

Find Your Best Rate

Compare Best Personal Loans

Personal Loan Payoff Calculator

Personal Loan Lender Reviews

Personal Loans By Credit

Personal Loans for Fair Credit

Personal Loans for Good Credit

Personal Loans for Excellent Credit

Personal Loan Types

Auto Repair Loans

Credit Card Consolidation Loans

Fast Personal Loans

Home Improvement Loans

Horse Barn Financing

Wedding Loans

Family Planning Loans

Funeral Financing

Land Purchase Financing

Manufactured Home Financing

Medical Loans

Cosmetic & Plastic Surgery Financing

Owner Builder Construction Loans

Personal Loans for House Down Payment

Personal Loans for Self Employed

Personal Loans for Furniture Expenses

Student Loans

Debt Consolidation Loans

Vacation & Travel Loans

Emergency Personal Loans

Personal Loans with Co-signers

Home Improvement Financing

Appliance Financing

Bathroom Remodel Financing

Basement Remodel Financing

Boat Dock Loans

Deck Financing

Driveway Paving Financing

Fence Financing

Flooring Financing

Furnace Financing

Garage Financing

Home Addition Financing

Hot Tub Financing

HVAC Financing

Home Insulation Financing

Interior & Exterior Painting Financing

Kitchen Remodel Financing

Kitchen Cabinet Financing

Pole Barn Financing

Roof Financing

Solar Panel Financing

Swimming Pool Financing

Sunroom Addition Loans

Window Replacement Financing

Loan rate & terms disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.