Kitchen Remodel Financing

Get pre-qualified for a kitchen remodeling loan in just minutes. Checking rates won’t affect your credit score

Kitchen Remodel Loans

Whether you intend to sell or you just want to improve the space that you live in - a kitchen remodel is a great way to make your home more beautiful while increasing the value of your home. Unfortunately, kitchen remodels can be quite expensive. The national average for a kitchen remodel is over $25,000.

This high cost has led many homeowners to look into financing for their kitchen remodels.

Applying for a kitchen remodeling loan is simple.

How Pasha Funding Works

Compare personal loan rates

Compare personal loan rates in July, 2025

What is kitchen remodel financing?

Kitchen remodel financing is an alternative to paying for your kitchen remodel upfront. You will receive financing, or a loan, and make monthly payments on it. This allows you to purchase and pay for everything upfront without needing the full amount in cash.

When remodeling a kitchen, you’ll find that the costs add up quickly. From appliances and countertops to cabinets and flooring, kitchen remodels aren’t cheap. There are many different avenues that homeowners can take when it comes to financing their remodel. There are private lenders, credit cards, and other options we’ll cover. One popular method is to take out a home equity loan or line of credit. This gives you the advantage of using the equity in your home to secure a larger loan with potentially lower interest rates. Another option is a personal loan, which doesn't require collateral but typically comes with higher interest rates. It's important to carefully consider your financial situation and compare different financing options before making a decision.

How does kitchen remodel financing work?

Kitchen remodel financing works by providing homeowners with a means to fund their kitchen renovation projects without having to pay the entire cost upfront. Instead, individuals can obtain a loan or financing agreement that allows them to make affordable monthly payments over a specified period.

Here's how the process typically works:

- Research and compare financing options: Start by researching and comparing different financing options available. These options may include traditional lenders such as banks or credit unions, as well as specialized home improvement loan providers. Private lenders and online platforms are also worth exploring.

- Submit an application: Once you have identified a suitable financing option, you will need to submit an application. The application process typically involves providing personal and financial information, including details about your income, credit history, and the estimated cost of your kitchen remodel.

- Evaluation of your application: Lenders will evaluate your application and determine whether you qualify for the financing. They will consider factors such as your credit score, income stability, and debt-to-income ratio.

- Approval and disbursement of funds: Upon approval, you will receive the funds necessary to cover your kitchen remodel expenses. This could include the cost of materials, appliances, labor, and any other relevant expenses.

- Review the terms and conditions: It's important to carefully review the terms and conditions of the financing agreement before accepting it. Pay close attention to details such as interest rates, repayment period, any additional fees or penalties for early repayment.

By understanding how kitchen remodel financing works and following these steps, you can make informed decisions about funding your renovation project while staying within your budget.

Can I finance a kitchen remodel?

Yes, you can finance a kitchen remodel. Many homeowners choose to finance their kitchen renovations through various financing options available such as loans, home equity lines of credit (HELOC), or personal lines of credit.

According to the National Kitchen and Bath Association (NKBA), the average cost of a kitchen remodel can vary based on the scope of the project, the quality of materials chosen, and the region. The NKBA estimates that a major kitchen remodel can range from $75,000 to $150,000 or more, depending on factors such as the size of the kitchen, the extent of the renovation, and the level of customization desired. However, it's important to note that these are average figures and actual costs can vary significantly.

Types of kitchen remodel financing options

Kitchen remodels may seem daunting for homeowners. There is a lot of work that needs to be done, they are expensive, and they can take a while. Luckily, there are plenty of options for homeowners seeking financing for their kitchen remodel project. Here are the most common.

Personal loans

Personal loans have become an increasingly popular choice for homeowners seeking to finance home improvement projects, such as kitchen remodels. They offer a number of benefits that make them an attractive option for many individuals.

A personal loan is a type of unsecured debt, meaning it does not require any collateral such as your home. This makes it a less risky option in comparison to secured loans like home equity loans or HELOCs which could potentially lead to the loss of your home if you fail to repay the loan.

When you opt for a personal loan, you receive a lump sum amount upfront, which you can use to fund your kitchen remodel. You're then required to pay back this amount, along with interest, in monthly installments over a fixed period of time known as the loan term.

Personal loans are readily available from various types of financial institutions. Here are some places you might consider:

- Banks: Traditional banks offer personal loans with competitive interest rates, especially for customers with strong credit profiles.

- Credit Unions: Credit unions often have lower interest rates than banks. However, membership is typically required.

- Online Lenders: Online lenders provide quick and easy application processes with fast approval times. They may also offer loans to those with lower credit scores.

Home equity options

Homeowners with significant equity in their homes may consider using it to finance their kitchen remodel. This can be done through a home equity loan or a HELOC. A home equity loan provides a lump sum of money with a fixed interest rate, while a HELOC works like a credit card, allowing you to borrow on an as-needed basis with a variable interest rate. Both options require using your home as collateral. While home equity options can provide access to larger loan amounts and potentially lower interest rates, they come with their own risks. Failure to repay a home equity loan or HELOC can result in foreclosure, leading to the loss of your home. Additionally, these options may have longer approval processes and require extensive documentation. It's essential to carefully consider your financial situation and weigh the pros and cons of each option before making a decision.

Credit cards

Utilizing credit cards as a means of financing a kitchen remodel can indeed be a handy solution. The convenience of swiping the card and instantly gaining access to funds can facilitate the smooth execution of your project. However, this method comes with its own set of considerations, primarily due to potentially high interest rates.

Understanding Credit Card Interest Rates

Interest rates on credit cards can vary greatly depending on the card issuer and your credit score. It's not uncommon for these rates to exceed 20%, significantly higher than most personal loans or home equity options. This means that, if you're unable to pay off the balance quickly, the cost of your remodel could increase significantly due to interest charges.

Here are some factors that affect your credit card interest rate:

- Your Credit Score: The better your credit score, the lower your interest rate is likely to be.

- Card Issuer Policies: Different card issuers have differing policies when it comes to setting interest rates.

- Variable vs Fixed Rate Cards: Some cards have variable interest rates that can change over time while others have fixed rates.

Developing a Repayment Strategy

If you choose to use a credit card for your kitchen remodel, it's critical to have a solid strategy in place for paying off the balance as soon as possible. Here are some steps you may want to consider:

- Set a Budget: Determine how much you can realistically afford to spend on your kitchen remodel and stick to this budget.

- Choose a Card with Favorable Terms: If possible, select a card with low interest rates or promotional offers such as an introductory 0% APR period.

- Plan Your Repayments: Figure out how much you need to pay each month in order to clear the balance before any promotional periods end or before interest begins accruing.

- Consider Balance Transfers: If you have another credit card with a lower interest rate, consider transferring the balance to that card after your remodel.

Remember, managing your credit wisely is crucial when using this method of financing. Used responsibly, a credit card can be an effective tool in achieving your dream kitchen. However, it's essential to undertake this path with a full understanding of the potential costs and risks involved.

Government programs

Certain government programs, such as FHA Title 1 loans or Energy Efficient Mortgages (EEMs), offer financing options specifically for home improvements. These programs may have specific eligibility criteria and requirements.

Considering your financial situation and goals, it's important to evaluate these options carefully and choose the one that best suits your needs. Seeking advice from a financial advisor or mortgage professional can help you make an informed decision."

Kitchen Remodel Financing Calculator

Total Payment

-

Total Interest

-

Monthly Payment

-

Ready to apply for a personal loan?

Compare rates from top lenders with no impact on your credit, ever.

Quick links

Ready to apply for a kitchen remodel loan? Get started.

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

Pros and cons of kitchen remodel financing

Pros of Kitchen Remodel Loans

- Increase Home Value: Remodeling your kitchen can significantly increase the value of your home. Especially for smaller remodels, you can expect a return on investment of up to 81%.

- Flexible Financing Options: There are various financing options available, including personal loans, home equity options, credit cards, and government programs. You can choose the one that best suits your needs.

- Makes Remodeling Affordable: Kitchen remodel loans allow homeowners to afford a kitchen upgrade without having to save up for years.

- Enhanced Comfort and Enjoyment: A remodeled kitchen can provide improved functionality, comfort, and enjoyment in your home.

Cons of Kitchen Remodel Loans

- Interest Rates: Depending on the type of loan you choose, you may face high interest rates. This is particularly true if you finance the remodel with a credit card.

- Debt: Taking out a loan means taking on debt which will need to be repaid over time.

- Risk of Overcapitalizing: While remodeling often increases home value, there is a risk you may not recoup all of your investment when selling the house.

- Requires Collateral: Some loan options like home equity loans require your home as collateral. If you cannot repay the loan, it might risk your ownership of the house.

- Eligibility Criteria: Government programs offering kitchen remodel loans usually have specific eligibility criteria which some homeowners might not meet.

Will upgrading my kitchen increase my home's value?

Absolutely, upgrading your kitchen can significantly increase the value of your home. A well-executed kitchen remodel can give a return on investment (ROI) of between 60-80%. The actual ROI will depend on the quality of the remodeling, the current market conditions, and other factors like the overall state of your home. However, it's important to bear in mind that while a kitchen remodel can increase your home value, overcapitalizing could result in not getting back the full amount you invested into the remodel when you sell your house.

Types of kitchen remodels

Not every kitchen requires a huge remodel. While some people want to replace every single aspect of their kitchen, even sometimes tearing down walls, others choose to go with a much simpler remodel.

Small Kitchen Remodel

While major kitchen remodels can be quite costly and time-consuming, a smaller remodel might be just what you need to refresh your cooking space while also potentially increasing the value of your home. Here's a closer look at some of the projects you might consider for a small kitchen remodel:

1. Painting Your Cabinets

One of the easier and more cost-effective ways to transform the look of your kitchen is by painting your cabinets. Choose a color that complements the rest of your kitchen decor. Lighter shades can make a small kitchen appear larger, while darker hues can add depth and sophistication.

2. Adding a Backsplash

A backsplash isn't just practical – it's also an excellent way to inject style into your kitchen. Use tiles in an interesting pattern or color for an eye-catching focal point. Remember, it's not necessary to choose expensive materials; ceramic or glass tiles can be equally striking and budget-friendly.

3. Painting the Walls

If you're not ready to commit to colored cabinets, painting the walls is another great way to introduce color into your kitchen. Try a bold shade for impact or stick with neutrals for a timeless look. Don't forget, paint finishes matter too; semi-gloss or satin finishes are typically recommended for kitchens due to their durability and ease of cleaning.

4. Installing New Light Fixtures

Lighting plays a critical role in both the functionality and aesthetics of your kitchen. Consider replacing outdated fixtures with modern ones that provide better illumination. You could opt for pendant lights over the island, under-cabinet lighting for task areas, or even recessed lighting if you want a sleek, contemporary feel.

5. Updating Faucets

Your faucet may seem like a small detail, but upgrading to a newer model can add significant visual interest and usability to your sink area. Modern faucets come with features like pull-down sprayers and touchless operation, making kitchen tasks easier while also enhancing the overall design.

By focusing on these projects, you can significantly transform your kitchen without undertaking a major remodel. Remember, even small changes can have a big impact on the overall look and feel of your space, so don't underestimate the power of a small kitchen remodel.

Mid-Level Kitchen Remodel

If you're looking to make substantial changes to your kitchen without venturing into the realm of a full-scale, high-end remodel, a mid-level remodel could be just the ticket. Offering more extensive updates than a minor remodel but still staying within manageable limits, this type of project strikes a fine balance between cost, effort, and results. Let's delve deeper into what a mid-level kitchen remodel could involve.

- Replacing Your Appliances Upgrading your appliances can not only improve the look and feel of your kitchen but also enhance its functionality. Consider investing in energy-efficient models that can lower your utility bills over time. For instance, swap out your old stove for one with induction cooking or replace your noisy dishwasher with a quieter, more water-efficient model.

- Revamping Your Countertops Countertops are a focal point in any kitchen, and changing them can dramatically alter the aesthetics of your space. Materials like granite, quartz, or even wood can offer durability as well as visual appeal. Remember to choose a material that fits your cooking habits and maintenance preferences.

- Installing New Cabinets Cabinets play a crucial role in defining the style of your kitchen. Opt for new cabinets that provide ample storage while complementing the overall design theme of your kitchen. From sleek, handle-less designs for a modern look to traditional shaker cabinets for a classic feel – the choices are plentiful.

- Laying New Flooring The right flooring can create harmony between different elements in your kitchen. Depending on your budget and taste, you could choose from options like hardwood for an elegant and timeless look, ceramic tiles for durability, or vinyl flooring for cost-effectiveness and easy maintenance.

- Updating Fixtures Last but not least, don't forget about fixtures such as handles and knobs on cabinets or modern light fixtures that can act as the perfect finishing touches to your kitchen. These seemingly small details can significantly boost the overall aesthetics of your kitchen.

A mid-level remodel is a great way to breathe new life into your kitchen without breaking the bank or committing to a lengthy renovation process. Take one step at a time, and you'll soon have a kitchen that's not only more beautiful but also more functional.

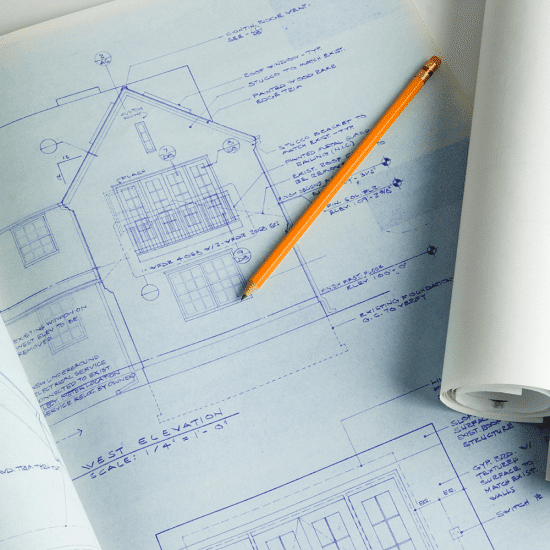

Major Remodel: The Ultimate Kitchen Transformation

In case you're looking for a complete overhaul of your kitchen space and budget constraints are not a limiting factor, embarking on a major remodel can be the perfect solution. This type of renovation goes beyond mere cosmetic changes, involving substantial modifications that can completely transform the character of your kitchen. A major remodel typically includes:

- Changing the Layout and Location of Appliances This involves restructuring the entire configuration of your kitchen. You might consider shifting appliances around to design a more efficient workflow, or maybe you want to create an open-plan kitchen-diner for a more spacious feel.

- Adding or Removing Windows and Doors Altering the number or size of windows can drastically increase natural light in your kitchen, creating an airy and welcoming ambiance. Similarly, adding, removing or relocating doors can improve accessibility and traffic flow in your kitchen.

- Removing Walls to Open Up Space If your current kitchen feels cramped or isolated from the rest of your home, taking down a wall can create an open-concept layout. This not only makes your kitchen appear larger but also encourages a more social atmosphere where family members and guests can interact freely.

- High-end Countertops Investing in premium countertops like granite, quartz or marble not only contributes to aesthetics but also offers durability and easy maintenance. These materials can withstand heat, resist stains and scratches, making them an ideal choice for busy kitchens.

- High-end Appliances Splurging on top-of-the-line appliances is another distinguishing feature of a major remodel. From smart refrigerators that help manage your groceries to professional-grade ranges for gourmet cooking; high-end appliances offer superior performance, sophisticated design, and often greater energy efficiency.

Remember: A major remodel is a significant commitment in terms of time, effort, and funds. Therefore, it's crucial to work with experienced professionals who can guide you through each step of the process, ensuring that the end result aligns with your vision and needs. By making thoughtful, well-planned decisions, you can create a kitchen that's as functional as it is beautiful.

Tips for budgeting for your kitchen remodel project

If you're considering a personal loan to finance your kitchen remodel, it's crucial to approach the project with careful planning and budgeting. Here are some indispensable tips to help you navigate the process:

1. Understand Your Financial Situation

Before embarking on any major expenditure, it's essential to have a clear understanding of your current financial situation. That includes knowing your credit score, monthly income, existing debts, and overall spending habits. This information will help determine what loan amount you can comfortably afford.

2. Define Your Remodeling Goals

Clearly define what you want to achieve with your kitchen remodel. Are you looking for a minor refresh or a major overhaul? The scope of your project will significantly influence your budget.

3. Estimate Costs

Once you've delineated your remodeling goals, start estimating the costs. This could involve:

- Researching prices online

- Consulting with contractors or kitchen remodel experts

- Visiting home improvement stores

Remember to account for unexpected expenses by adding a 10-20% contingency fund to your estimated budget.

4. Shop Around for Personal Loans

Different lenders offer different interest rates and terms on personal loans. Take the time to research and compare various loan options from banks, credit unions, and online lenders. Look for a loan that offers competitive interest rates, flexible repayment terms, and minimal fees.

5. Make a Repayment Plan

Before accepting a loan offer, make sure you have a solid plan in place for repaying the borrowed amount. Factor in the monthly repayments into your budget, ensuring they don't strain your finances too much.

6. Scour for Deals and Discounts

Look out for sales, discounts or special deals at home improvement stores or online platforms that could potentially save you money on appliances or materials.

Remember this key point: Approach every step of your kitchen remodeling project with thorough budgeting and careful financial planning, and you'll be well on your way to creating the kitchen of your dreams without breaking the bank.

Credit Score Requirements For Kitchen Remodel Loans

The credit score you need to qualify for a kitchen remodel loan can differ from one lender to another. But as a rule of thumb, stronger credit scores typically open the door to more advantageous loan terms and interest rates. You may be wondering, "What exactly is a 'good' credit score?" Most lenders regard a credit score of 660 or higher as good, which could make you eligible for competitive loan options.

However, it's crucial to bear in mind that your credit score isn't the only factor that lenders scrutinize when assessing loan applications. They'll also take into account:

- Income: Lenders want to ensure you have a steady income that can support your loan repayments.

- Debt-to-Income Ratio (DTI): This figure represents the percentage of your monthly gross income that goes towards paying off debts. A lower DTI is generally more favorable.

- Employment History: Lenders often look at the stability of your employment history as an indicator of your ability to repay the loan.

It's wise to not solely rely on your credit score but also work on improving these other aspects of your financial profile if necessary.

Before you apply for a loan, it's always advisable to check with several lenders to understand their specific requirements. Many financial institutions offer pre-qualification options that allow you to see potential interest rates and terms without affecting your credit score. This step can give you a clearer idea of what loan options may be available to you before you officially apply.

In conclusion, while having a good credit score of around 660 or more can positively influence your chances of securing a kitchen remodel loan with favorable terms, don't forget about the other pieces of your financial picture. Make sure to do your homework and explore all options available to you for financing your kitchen remodel.

Is financing a kitchen remodel a good idea?

The decision to remodel your kitchen can significantly impact your finances and overall home value. It's essential to take a calculated approach, weighing the pros and cons based on your financial situation and long-term plans.

Kitchen remodeling is a good investment if:

- You Have a Solid Budget Plan: Having a clear budget that can comfortably accommodate the financing is crucial. This means you've done your homework, factored in all costs related to the remodel, and have a clear understanding of the monthly payments that will be required.

- You're Planning to Increase Home Value for Resale: Remodeling your kitchen can be an excellent way to boost your property's value if you're planning to sell in the future. A modern, functional kitchen is often a top selling point for potential buyers.

- You Have a Good Credit Score: A good credit score not only increases your chances of getting approved for financing but also often results in more favorable loan terms and interest rates, making the overall cost of the remodel more affordable.

- You Secure a Low-Interest Rate: The lower your interest rate, the less you'll pay over the life of your loan. It's always advisable to shop around for the best rates before settling on a financing option.

- You're Committed to Making Every Monthly Payment: Consistent payment behavior improves your credit history and score, making it easier for you to secure loans in the future.

If all these factors align favorably, then financing a kitchen remodel could be an excellent choice for you. However, it's always recommended to seek professional financial advice before making such decisions.

How to apply for kitchen financing

Applying for kitchen financing involves a few key steps:

1. Determine your budget: Before applying for financing, it's important to have a clear understanding of how much you can afford to borrow and repay each month.

2. Research lenders: Explore different lenders and their financing options. Look for ones that specialize in home improvement loans or offer competitive interest rates.

3. Gather necessary documents: Depending on the lender, you may need to provide documents such as proof of income, identification, and details about the remodeling project.

4. Submit your application: Fill out the application form accurately and provide all required information. Double-check for any errors or missing details before submitting.

5. Review loan terms: If approved, carefully review the loan terms, including interest rates, repayment period, and any fees associated with the loan.

6. Accept the loan: If you're satisfied with the terms, accept the loan offer and proceed with the kitchen remodel.

Remember to compare multiple financing options to ensure you're getting the best deal possible.

Compare personal loans from top lenders

Are you ready to find a personal loan for your needs? We've partnered with Credible to help you find your rate. Checking your score is free and won't impact your credit!

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

Find Your Best Rate

Compare Best Personal Loans

Personal Loan Payoff Calculator

Personal Loan Lender Reviews

Personal Loans By Credit

Personal Loans for Fair Credit

Personal Loans for Good Credit

Personal Loans for Excellent Credit

Personal Loan Types

Auto Repair Loans

Credit Card Consolidation Loans

Fast Personal Loans

Home Improvement Loans

Horse Barn Financing

Wedding Loans

Family Planning Loans

Funeral Financing

Land Purchase Financing

Manufactured Home Financing

Medical Loans

Cosmetic & Plastic Surgery Financing

Owner Builder Construction Loans

Personal Loans for House Down Payment

Personal Loans for Self Employed

Personal Loans for Furniture Expenses

Student Loans

Debt Consolidation Loans

Vacation & Travel Loans

Emergency Personal Loans

Personal Loans with Co-signers

Home Improvement Financing

Appliance Financing

Bathroom Remodel Financing

Basement Remodel Financing

Boat Dock Loans

Deck Financing

Driveway Paving Financing

Fence Financing

Flooring Financing

Furnace Financing

Garage Financing

Home Addition Financing

Hot Tub Financing

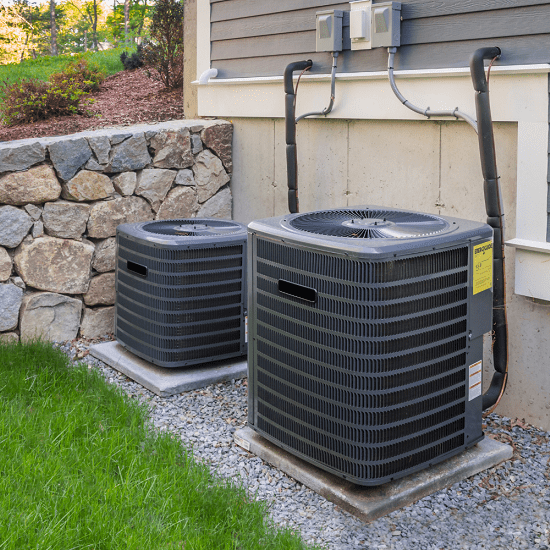

HVAC Financing

Home Insulation Financing

Interior & Exterior Painting Financing

Kitchen Remodel Financing

Kitchen Cabinet Financing

Pole Barn Financing

Roof Financing

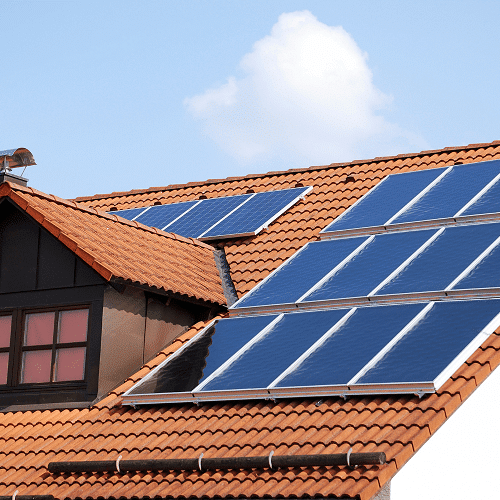

Solar Panel Financing

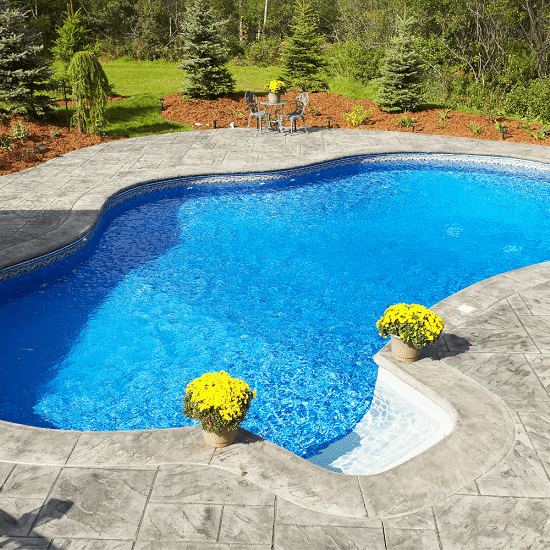

Swimming Pool Financing

Sunroom Addition Loans

Window Replacement Financing

Loan rate & terms disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.