New Furnace Financing

Get pre-qualified for a personal loan in just minutes. Checking rates won’t affect your credit score

Furnace loans for good & bad credit

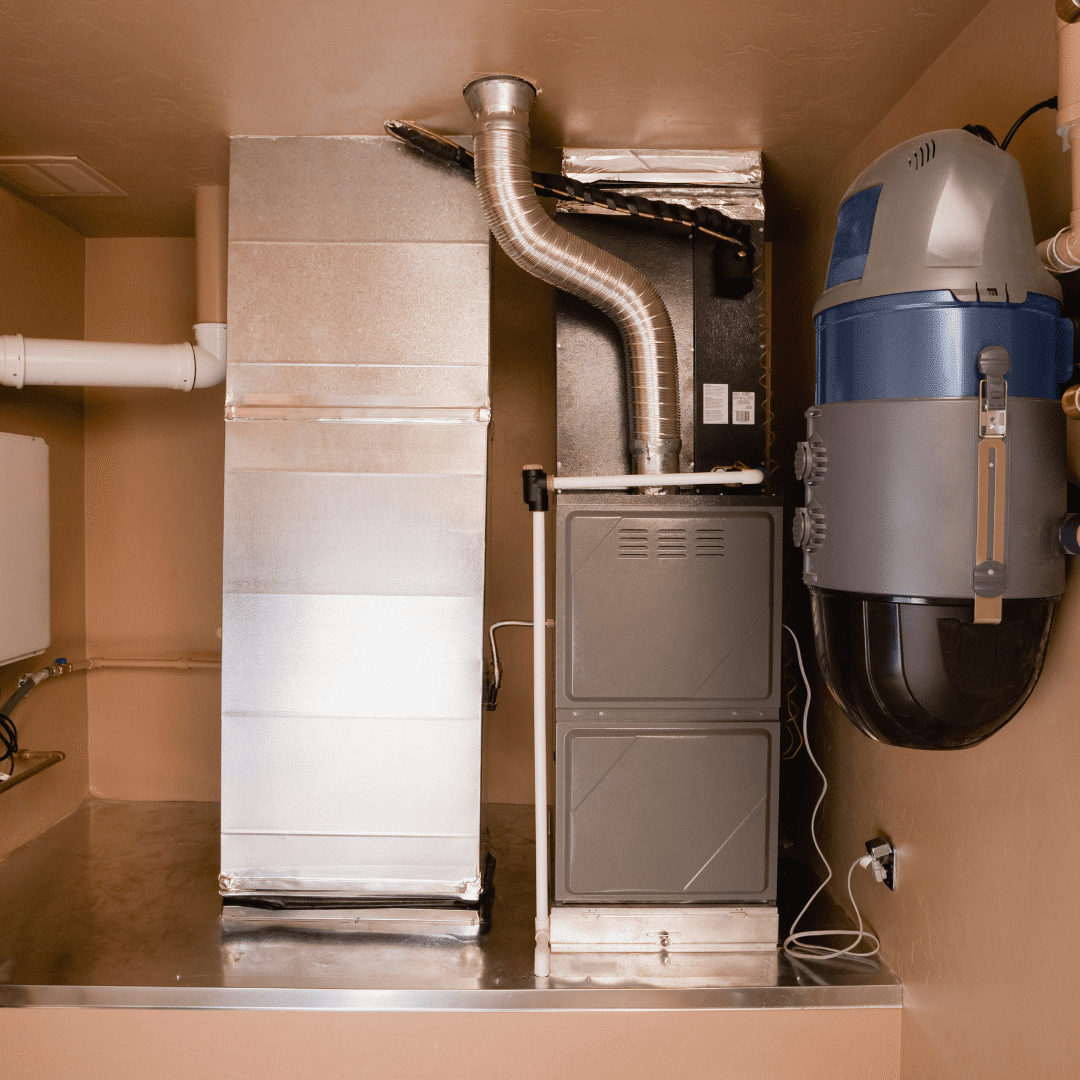

Most of us would struggle without a fully functioning furnace. There are not many places in the U.S. where you don’t need heat at some point of the year and there are quite a lot where living through the winter would be verging on impossible without the comfort that only a furnace can supply.

But furnaces don’t last forever, and when it comes time to replace one, you soon find it’s not going to be cheap to get your heating back up and running. If your furnace is failing or has given up on life you’ll likely need to consider your financing options to get everything in order before the cold weather hits.

Applying for furnace financing is fast and easy:

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

How Pasha Funding Works

Compare personal loan rates

Compare personal loan rates in October, 2024

Can you finance a new furnace?

Yes, it is possible to finance a new furnace. Many homeowners opt for financing options to cover the cost of purchasing and installing a new furnace. Financing allows you to spread out the expense over a period of time, making it more manageable for your budget.

How much does a new furnace cost?

The cost of a furnace depends on its capacity and sophistication. You might expect to pay between $1,500 and $2,500 for a mid-efficiency unit – that’s a furnace that has an 80% to 89% annual fuel efficiency (AFUE) rating. A more efficient furnace, with an AFUE rating of greater than 90%, will cost more – somewhere in the $3,000 to $5,000 range.

Higher efficiency means that less of the fuel consumed is wasted. However, though this saves on your energy bills, not only do high-efficiency furnaces cost more to buy, they are often more expensive to repair when they go wrong. Ideally, go for a new furnace that has an AFUE rating above 90% but not more than 95%, that’s when repairs get seriously more costly.

On top of the cost of the furnace itself, you need to add in installation costs, generally in the $1,000 ballpark, plus changing the filter regularly and an annual service. Filters are pretty cheap – around $5 to $30, and a service is around $120.

Generally, you need somewhere between $3,500 and $6,000 to replace your old furnace.

How do you finance a new furnace?

Personal Loan

Most people will find a personal loan is the most affordable way to finance a new furnace. Rates are generally low, between 11-24% for those with reasonable credit and lower for those with excellent credit. Using a personal loan means you won’t have any nasty surprises down the line and you know you’ll pay it off in the defined time frame. It’s also tied to you, rather than your home as some of the other options we’ll cover shortly.

In-House

Furnace installation companies often offer finance in partnership with an approved lender. This can make the whole process straightforward but you need to check that you can’t get cheaper finance elsewhere. Make sure you read the fine print before signing.

Credit Cards

Getting a credit card to fund a new furnace might be an option so long as the amount required is not too great and you can qualify for a low-interest credit card or one with a long 0% APR period. Make sure you budget carefully so that you pay off the loan before that period runs out. Any outstanding amount will be hit with a normal credit card APR and that’s not the cheapest form of finance, though a balance transfer may be an option.

HELOC

Approaching a lender that offers a home equity line of credit (HELOC) may be an attractive choice for finance. Operating much like a credit card, a HELOC often offers high credit limits, low-interest rates, and long repayment periods. The only downside is that a HELOC is much like a second mortgage and should you default, the lender has the right to seize your home.

Home Equity Loan

A home equity loan is a second mortgage, and as such, usually has a low interest rate and long term, typically 5 - 15 years. It is often a cheaper option than a HELOC but has the same possible problem that your home is collateral for the loan.

401(k) Loan

Another option worth mentioning here is a 401(k) loan. Some retirement plan providers allow you to take out a loan from your future retirement savings. Provided you’ve saved at least double the cost of your new furnace for retirement, you should be able to borrow from yourself. This requires no credit check or interest, but you need to fully understand how it will set your retirement plans back. That said, a new furnace for your home is a good reason to borrow from your future.

Rent-to-Buy

Some furnace companies offer essentially furnace leasing so you pay a monthly fee and then a lump sum at the end of the term. This usually requires no credit check. The terms and costs around this vary significantly, so if a company near you offers this do your research thoroughly to ensure it’s the right option for you.

Government Programs

The government has schemes that help those on low incomes, with special needs, and to help improve the environment. Start by checking out the Low Income Home Energy Assistance Program (LIHEAP), the Energy Star Program, and the Weatherization Assistance Program.

Quick links

Ready to get a new furnace loan? Get started today.

Compare personal loan rates

What credit score is needed to finance a furnace?

The specific credit score required to finance a furnace can vary depending on the lender or financing option you choose. Generally, a credit score of 600 or higher is considered a fair credit score and may be sufficient to qualify for furnace financing. However, lenders may have their own eligibility criteria, and some may require a higher credit score for approval.

It's important to note that your credit score is not the sole factor considered by lenders when evaluating your loan application. They may also assess your income, debt-to-income ratio, employment history, and other financial factors. Having a higher credit score generally increases your chances of qualifying for better loan terms, such as lower interest rates and more favorable repayment options.

If your credit score is below the desired range, you may still have options for furnace financing. Some lenders specialize in working with individuals who have lower credit scores or offer alternative financing programs. However, these options may come with higher interest rates or more stringent terms.

How long can you finance a furnace for?

The duration of financing options for a furnace can vary depending on the lender and the terms of the loan. Typically, furnace financing terms can range from 1 to 10 years. However, it's important to note that the exact available loan terms may vary based on the lender's offerings and your specific financial circumstances.

Shorter-term financing options, such as 1 to 5 years, are common for smaller loan amounts or when borrowers prefer to pay off the debt relatively quickly. These shorter terms may come with higher monthly payments but result in less interest paid over the life of the loan.

Longer-term financing options, such as 6 to 10 years, are often available for larger loan amounts or when borrowers prefer lower monthly payments. However, longer-term loans typically accrue more interest over time.

New furnace loan payment calculator

Total Payment

-

Total Interest

-

Monthly Payment

-

Ready to apply for a personal loan?

Compare rates from top lenders with no impact on your credit, ever.

What are the pros and cons of furnace financing?

Pros:

- No one wants to wait to get a working furnace, and getting finance means you can get a new furnace when you need to.

- A loan allows you to spread payments rather than having to find a single large lump sum.

- Taking out a loan and making sure repayments are on time for the duration of the loan actually helps to improve your credit score.

- A new furnace will almost certainly be more efficient than your old one and so be more economical to run.

Cons:

- Getting finance is nearly always more expensive than paying with your own money.

- Repayments are another monthly outgoing that could put pressure on your income.

- If you miss payments your credit score will suffer.

Should I finance a furnace?

Deciding whether to finance a furnace or not depends on your individual financial situation and priorities. Here are some factors to consider when making this decision:

- Affordability: Assess your budget and determine if you have enough funds to cover the cost of a new furnace outright. If paying for a furnace upfront will strain your finances or deplete your emergency savings, financing may be a viable option.

- Urgency: If your current furnace is no longer functional or poses safety risks, replacing it promptly may be necessary. Financing can help you address the immediate need for a new furnace without having to wait until you have sufficient savings.

- Energy Efficiency: Upgrading to a more energy-efficient furnace can lead to long-term savings on utility bills. Financing the purchase allows you to start benefiting from those savings sooner rather than later, offsetting the cost of financing.

- Return on Investment: Consider the potential increase in your home's value by installing a new, efficient furnace. If you plan to sell your home in the near future, financing a furnace upgrade could be seen as a worthwhile investment.

- Interest Rates and Terms: Evaluate the interest rates, repayment terms, and any fees associated with furnace financing. Compare multiple financing options to ensure you secure the most favorable terms and rates available to you.

- Other Financial Goals: Assess your overall financial situation and consider if financing a furnace aligns with your other financial goals. If you have higher-interest debt or more pressing financial needs, it may be prudent to prioritize those before taking on additional debt.

How much will furnace financing cost?

The cost of furnace financing depends on several factors, including the loan amount, interest rate, repayment term, and any associated fees or charges. Here's a breakdown of the potential costs to consider:

- Principal Amount: The total amount you finance for the furnace purchase, which includes the cost of the furnace itself, installation fees, and any additional expenses.

- Interest Charges: The interest you'll pay over the life of the loan. The interest rate will vary based on factors such as your credit score, the lender, and the current market conditions. A higher interest rate will result in more interest charges, increasing the overall cost of financing.

- Repayment Term: The duration of the loan affects the total interest paid. Longer repayment terms may result in more interest charges over time, while shorter terms can lead to higher monthly payments but lower overall interest costs.

- Fees and Charges: Some lenders may charge origination fees, application fees, or other associated costs. It's important to carefully review the terms and conditions to understand the potential fees involved.

How to apply for new furnace financing

Applying for new furnace financing typically involves the following steps:

- Research and Compare: Begin by researching different lenders and financing options available to you. Look for lenders that offer specific financing programs for home improvements, HVAC upgrades, or energy-efficient equipment. Compare interest rates, repayment terms, eligibility criteria, and customer reviews to find the best fit for your needs.

- Gather Documentation: Lenders will require certain documentation to process your loan application. Common documents may include proof of income (such as pay stubs or tax returns), identification (driver's license, passport), proof of homeownership, and information about the furnace you intend to purchase (quotes, specifications).

- Preparation: Before applying, take steps to improve your creditworthiness. Check your credit report for any errors or discrepancies, and take measures to address them. Pay down existing debt, make timely bill payments, and aim to improve your credit score, as a higher credit score can lead to more favorable financing terms.

- Loan Application: Once you've selected a lender, visit their website or contact them directly to initiate the application process. Complete the loan application form, providing accurate and up-to-date information about your financial situation, employment, and the furnace you wish to finance. Double-check the application for any errors or missing information.

- Approval and Review: After submitting your application, the lender will review your information and assess your creditworthiness. This may involve a credit check and verification of the provided documentation. Some lenders may offer instant approvals, while others may take a few days to process your application.

- Loan Acceptance and Terms: If your application is approved, carefully review the loan terms, including the interest rate, repayment period, monthly payments, and any associated fees or charges. Ensure that you understand the terms and conditions before accepting the loan offer.

- Loan Disbursement: Upon accepting the loan offer, the lender will disburse the funds directly to you or the furnace provider, depending on the lender's policies. The funds can then be used to purchase and install the new furnace.

Personal Loans for Every Occasion

Find Your Best Rate

Compare Best Personal Loans

Personal Loan Payoff Calculator

Personal Loan Lender Reviews

Personal Loans By Credit

Personal Loans for Fair Credit

Personal Loans for Good Credit

Personal Loans for Excellent Credit

Personal Loan Types

Auto Repair Loans

Credit Card Consolidation Loans

Fast Personal Loans

Home Improvement Loans

Horse Barn Financing

Wedding Loans

Family Planning Loans

Funeral Financing

Land Purchase Financing

Manufactured Home Financing

Medical Loans

Cosmetic & Plastic Surgery Financing

Owner Builder Construction Loans

Personal Loans for House Down Payment

Personal Loans for Self Employed

Personal Loans for Furniture Expenses

Student Loans

Debt Consolidation Loans

Vacation & Travel Loans

Emergency Personal Loans

Personal Loans with Co-signers

Home Improvement Financing

Appliance Financing

Bathroom Remodel Financing

Basement Remodel Financing

Boat Dock Loans

Deck Financing

Driveway Paving Financing

Fence Financing

Flooring Financing

Furnace Financing

Garage Financing

Home Addition Financing

Hot Tub Financing

HVAC Financing

Home Insulation Financing

Interior & Exterior Painting Financing

Kitchen Remodel Financing

Kitchen Cabinet Financing

Pole Barn Financing

Roof Financing

Solar Panel Financing

Swimming Pool Financing

Sunroom Addition Loans

Window Replacement Financing

Loan rate & terms disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.