Best Solar Panel Loans of 2025

Get pre-qualified for a solar panel loan in just minutes. Checking rates won’t affect your credit score

Solar Panel Financing: How to Pay for Solar Panels

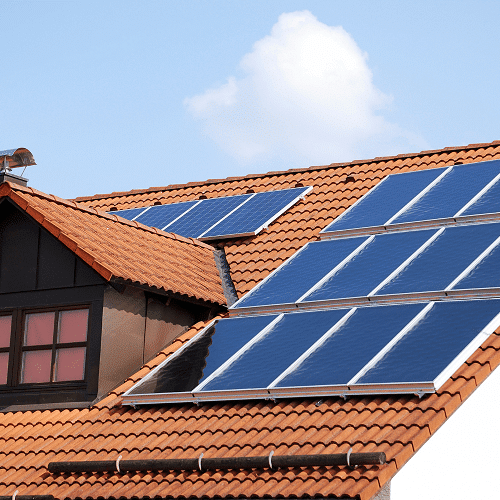

Investing in solar power for your home can provide several financial and environmental benefits, increasing your home’s value and leaving you with cheap energy bills. While this process can save you money in the long run, it’s quite expensive up-front. For this reason, many people choose to finance this project by other means.

If you’re considering having solar panels installed in your home, you may already have considered how you’ll cover the cost of the installation. Read on to learn about solar panel financing: the cost involved, necessary credit history, and some of the best lenders for this job.

Applying for a solar panel loan is fast and easy:

How Pasha Funding Works

Compare personal loan rates

Compare personal loan rates in July, 2025

Can solar panels be financed?

Yes, solar panels can be financed through various financing options specifically designed for solar projects. Financing options for solar panels allow homeowners to spread out the cost of the solar system over time, making it more affordable and accessible.

How much does it cost to get solar panels installed?

The cost of installing solar panels can vary depending on several factors, including the size of the system, the type of panels used, the location, the complexity of the installation, and any additional components or features. Additionally, prices may vary over time due to factors such as market trends, government incentives, and advancements in technology. However, to provide a general idea, here are some approximate cost ranges:

- Residential Solar System: For a typical residential solar system in the United States, the cost can range from $10,000 to $30,000 or more. This range is before any available incentives or tax credits are applied. The average cost per watt can be around $2.50 to $4.00.

- Size of the System: The size of the solar system is often measured in kilowatts (kW) or watts (W). The more electricity you want the system to generate, the larger the system needs to be, and the higher the cost. Residential systems can range from 3 kW to 10 kW or more.

- Type of Panels: The type and brand of solar panels can impact the overall cost. Different panels have varying levels of efficiency, durability, and warranties. Higher-quality panels may come with a higher price tag.

- Additional Equipment and Features: In addition to solar panels, the cost of installation may include inverters, mounting equipment, wiring, monitoring systems, and any necessary permits. Additionally, if you opt for battery storage systems, that can add to the overall cost.

- Government Incentives and Tax Credits: It's important to consider available government incentives and tax credits that can help offset the cost of solar panel installation. These incentives can vary by location and may include federal tax credits, state or local rebates, grants, or net metering programs.

How can solar panels be financed?

- Personal loans are generally a good option if you have good credit as you’ll likely be approved for a low-interest rate, making borrowing very affordable. How much you can borrow will depend on your creditworthiness and income, but you can receive your funding in as little as 2 hours after approval, and pay the loan off over a term of (typically) 2-5 years.

- FHA loans are insured by the Federal Housing Administration and are secured by your home. But unlike home equity loans, if you cannot repay the loan, the bank will not foreclose on your home. This is because lenders can collect insurance from the Federal Housing Administration for up to 90 percent of any loan. Note that you will (usually) need some kind of down payment if the value of the loan is over $7,500. To find out more about FHA loans, click here.

- Home equity loans are similar to personal loans in that they have consistent monthly payments, fixed interest rates, and fixed repayment timelines. The difference is they are a loan on your home equity, so work much like a mortgage, and will put your home at risk if you default.

- Solar Leases: With a solar lease, a third-party solar provider installs and owns the solar panels on your property. In return, you make monthly lease payments to the provider for the use of the panels and the energy they produce. Solar leases often have little to no upfront costs, and the provider typically handles maintenance and repairs. However, keep in mind that you do not own the solar panels in this arrangement, and the savings may be lower compared to owning the system outright.

- HELOCs are like credit cards and provide a line of credit that lenders borrow against. Here, lenders generally have a variable interest rate, so your payment is liable to increase or decrease as their interest rate and account balance fluctuate. Like home equity loans, HELOCs are secured against the equity you have in your home, so you may lose your home if you get into financial difficulties.

- 401(k) loans: many 401(k) plans allow you to take out a loan of up to 50% of your current retirement account value, or $50,000, whichever is smaller. This is a good option if you have bad credit, as no credit check is required. Be aware, however, that they usually restrict your account in some way until you pay off the loan, so it can affect your long-term retirement aims.

Quick links

Ready to apply for a solar panel loan? Get started.

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

Do solar panel installers offer financing?

Yes, certain installation companies offer financing. Some offer long repayment periods, while some will allow you to pay for your solar panels minus the tax credit, and then they’ll keep the tax credit to pay off the remaining balance of your solar panel installation. If they offer full financing through a partner lender, make sure you compare what they offer with what you could get from an external lender.

Is it smart to finance solar panels?

If you can easily afford the repayments, then it may help you reduce your energy bills and increase the value of your home. That said, you also need to consider if you have the weather to make the most of them. People living in sunny areas can even get paid by the electricity company they’re connected to for the surplus electricity their panels produce, but if you live in Seattle, you’re probably not going to get the same benefits.

Are there solar tax credits available?

If you take out a loan to pay for solar panel installation, you’ll qualify for the solar tax credit or investment tax credit (ITC). This federal incentive lets people claim back 26% of their total solar panel installation costs as part of their taxes.

Is a solar loan tax-deductible?

FHA-backed solar loans are usually tax-deductible. The amount you’ll save will depend on your tax liability.

What are the pros and cons of solar panel financing?

Here are some pros of solar panel financing:

- It adds value to your home as some people specifically look for solar panels when buying a home. More specifically, for a house worth $500,000 solar panels would add $21,500 in overall value

- It’s future-proof as it relies on a renewable energy source

- It’s better for the planet because it reduces the demand for fossil fuel-based energy

- You may make money from solar panels by selling your energy back to the grid

Here are some cons of solar panel financing:

- Solar panel technology is advancing quickly, so you may still be paying for panels that aren't as efficient as those in 3-10 years

- Financing anything that you borrow money for will cost more money than if you’d saved up and paid for it up-front, and you may not get your money back if you sell your home

What credit score do I need to finance solar panels?

The specific credit score requirement to finance solar panels can vary depending on the lender and the type of financing option you choose. Different lenders have different criteria and may consider multiple factors in addition to credit score when evaluating loan applications. However, in general, a higher credit score improves your chances of qualifying for favorable terms and competitive interest rates.

To give you a general idea, a credit score in the range of 650 to 700 or above is often considered good and may help you qualify for solar financing options. Lenders typically view borrowers with higher credit scores as less risky and more likely to repay the loan on time. However, it's important to note that credit score requirements can vary, and some lenders may be more lenient or have specific programs designed for borrowers with lower credit scores.

Can I finance solar panels if I have a low credit score?

While having a low credit score may pose some challenges, there are financing options available specifically designed for individuals with lower credit scores. Some lenders offer specialized programs or consider additional factors beyond credit score when evaluating loan applications. Exploring these options can help you secure financing for your solar panels.

What are the advantages of financing solar panels instead of paying upfront?

Financing solar panels allows you to spread out the cost over time, making them more affordable and accessible. It enables you to start saving on your electricity bills immediately while paying off the system gradually. Additionally, financing options often come with attractive interest rates and flexible repayment terms, allowing you to manage your budget effectively.

What happens if I sell my home before I finish paying off the solar loan?

In most cases, if you sell your home before fully paying off the solar loan, the loan balance can be transferred to the new homeowner. This transfer of loan responsibility is known as a loan assumption or transfer of liability. However, the specific terms and conditions may vary depending on the lender and the loan agreement. It's important to review your loan agreement and discuss the options with your lender if you plan to sell your home before completing the loan term.

Apply for solar panel financing

- Research Financing Options: Explore different financing options available to you, such as solar loans, home equity loans, or specialized solar financing programs. Compare interest rates, terms, and eligibility requirements to find the best fit for your needs.

- Gather Documentation: Prepare the necessary documents for the loan application process. This may include proof of income, bank statements, identification documents, and any additional paperwork required by the lender.

- Estimate Your Solar System Cost: Determine the estimated cost of your solar panel installation by obtaining quotes from solar installation companies. This will help you determine the loan amount you need to finance.

- Check Your Credit Score: Obtain a copy of your credit report to review your credit history and ensure its accuracy. Lenders will consider your credit score during the application process, so it's essential to be aware of your current standing.

- Complete the Loan Application: Fill out the loan application form provided by the lender. Provide accurate and detailed information about your financial situation, income, employment history, and the specific details of your solar project.

- Submit Supporting Documents: Along with the application form, submit the required supporting documents as requested by the lender. This may include income verification, tax returns, bank statements, or any other documentation necessary to assess your creditworthiness.

- Await Loan Approval: Once you've submitted your application and supporting documents, the lender will review your information and make a decision. This process may take some time, so be patient while awaiting approval.

- Review Loan Terms: If your loan application is approved, carefully review the loan terms and conditions presented by the lender. Pay attention to interest rates, repayment schedules, fees, and any other relevant details.

- Sign Loan Agreement: If you agree to the terms and conditions, sign the loan agreement to finalize the financing arrangement. Make sure you understand all the terms outlined in the agreement before proceeding.

- Begin Installation Process: With the financing secured, work with your chosen solar installation company to schedule and begin the installation of your solar panels. Coordinate with them to ensure a smooth process from financing to installation.

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

Find Your Best Rate

Compare Best Personal Loans

Personal Loan Payoff Calculator

Personal Loan Lender Reviews

Personal Loans By Credit

Personal Loans for Fair Credit

Personal Loans for Good Credit

Personal Loans for Excellent Credit

Personal Loan Types

Auto Repair Loans

Credit Card Consolidation Loans

Fast Personal Loans

Home Improvement Loans

Horse Barn Financing

Wedding Loans

Family Planning Loans

Funeral Financing

Land Purchase Financing

Manufactured Home Financing

Medical Loans

Cosmetic & Plastic Surgery Financing

Owner Builder Construction Loans

Personal Loans for House Down Payment

Personal Loans for Self Employed

Personal Loans for Furniture Expenses

Student Loans

Debt Consolidation Loans

Vacation & Travel Loans

Emergency Personal Loans

Personal Loans with Co-signers

Home Improvement Financing

Appliance Financing

Bathroom Remodel Financing

Basement Remodel Financing

Boat Dock Loans

Deck Financing

Driveway Paving Financing

Fence Financing

Flooring Financing

Furnace Financing

Garage Financing

Home Addition Financing

Hot Tub Financing

HVAC Financing

Home Insulation Financing

Interior & Exterior Painting Financing

Kitchen Remodel Financing

Kitchen Cabinet Financing

Pole Barn Financing

Roof Financing

Solar Panel Financing

Swimming Pool Financing

Sunroom Addition Loans

Window Replacement Financing

Loan rate & terms disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.