Home Addition Financing

Get pre-qualified for a home addition loan in just minutes. Checking rates won’t affect your credit score

How to Fund Home Addition or Expansion

Moving house is never easy, especially if you love the area you’re in and know that not much comes up in the area that would suit your family. Fortunately, moving home isn’t the only way to upsize your home and in strong market like that we have experienced since the pandemic, it may be the most affordable way to stay in your area and have the space you need. Of course, home additions aren’t cheap, and so you’ll need to think about home addition financing.

Applying for a home addition loan is fast and easy:

How Pasha Funding Works

Compare personal loan rates

Compare personal loan rates in July, 2025

Can you finance a home addition?

Yes - because it is such a large project and a costly undertaking, most people have to look to financing to pay for a home addition. There are a range of options available to you for how you can finance your home addition, which we’ll guide you through below.

How much does a home addition cost?

The varies hugely depending on where you live, what kind of addition you want, and the current cost of materials. According to HomeAdvisor, the average cost of a home addition is $46,343, though they can be anywhere from $20,000 - $75,000, depending on what you want.

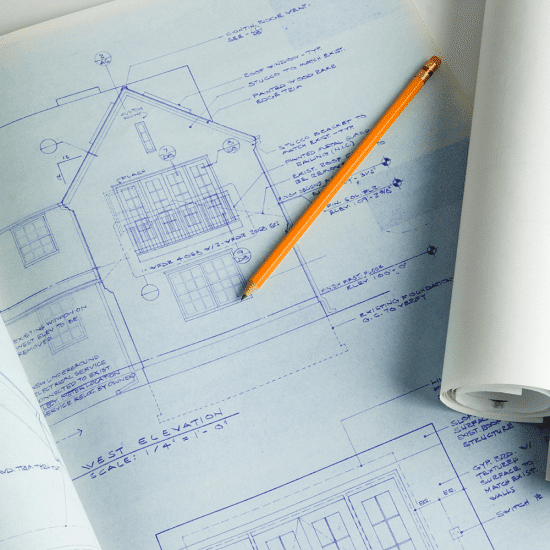

Types of home additions & expansions

Yes, there are various types of home additions that can expand your living space and enhance the functionality of your home. Here are some common types of home additions:

- Room Addition: This involves adding a completely new room to your existing home. It could be a bedroom, bathroom, home office, family room, or any other type of room you desire.

- Bump-out Addition: A bump-out involves extending an existing room outward, usually to create additional floor space. It can be used to expand a kitchen, living room, or dining area, providing a little extra room without the need for a full-scale addition.

- Sunroom or Conservatory: A sunroom or conservatory is a room primarily made of glass that allows natural light to flood in and offers views of the outdoors. It provides a versatile space that can be used for relaxation, entertaining, or indoor gardening.

- Garage Conversion: Converting an existing garage into livable space is a popular home addition option. It can be transformed into a bedroom, home office, gym, or even a separate living unit.

- Second-Story Addition: This involves adding an entire second story to your home, effectively doubling the living space. Second-story additions are suitable for expanding homes with limited land space.

- In-law Suite: An in-law suite is a separate living space within the home that typically includes a bedroom, bathroom, living area, and sometimes a kitchenette. It provides independent living quarters for extended family members or can be used as a rental unit.

- Basement Conversion: Converting an unfinished basement into usable living space is a cost-effective way to add square footage. It can be transformed into a recreation room, home theater, guest suite, or home office.

- Deck or Patio Addition: While not an indoor addition, adding a deck or patio to your home extends your living space outdoors. It provides an area for outdoor seating, dining, and entertaining.

Home addition financing & loan options

- Financing through your contractor: Large contractors that specialize in home additions may work with a partner lender to help arrange financing for the project. If your contractor does offer this, make sure you compare what they’re offering you with external lenders so you can make sure you’re getting the project for the lowest total cost you can.

- Personal loan: If you are looking for a small extension or have a high enough income and good enough credit score to qualify for a large loan, a personal loan can be the best way to find the financing you need. These loans have the benefit of being unsecured, so you don’t need to leverage your home’s equity to get your finance, which will keep your home safe if you got into financial difficulty.

- HELOC: A home equity line of credit is one of the best ways to leverage your home equity to pay for the addition. This is where a lender gives you access to a line of credit with a maximum credit limit (like you have with a credit card) and only pay interest on the money you borrow. This can be a good option if you aren’t paying for the addition upfront.

- Home Equity Loan: This loan is another that leverages your home equity, but is essentially a second mortgage.

- Cash-Out Refinance: If you’re considering a home equity loan, also consider cash-out refinancing, which is remortgaging to see if you can release the equity in that way. For example, if your first loan was for $325,000, you could increase your mortgage to $400,000 for a large home addition (give or take some depending on how long you’ve had the original mortgage) and use the $75,000 to pay for the addition.

- Rural Housing Loan: If you have a relatively low income and live in a rural area, you may be able to qualify for a rural housing loan from (or guaranteed by) the government. To find out more about this option, click here.

How much can you borrow for a home addition or expansion?

The amount you can borrow for a home addition depends on several factors, including your financial situation, the scope of the project, and the lender's policies. Here are some factors to consider:

- Equity in Your Home: Lenders often consider the available equity in your home when determining how much you can borrow. Equity is the difference between the current market value of your home and the outstanding balance on your mortgage. Generally, lenders may allow you to borrow up to a certain percentage of your home's appraised value or available equity.

- Loan-to-Value Ratio (LTV): Lenders typically have maximum LTV ratios, which determine the percentage of your home's value that can be borrowed. For example, if a lender allows a maximum LTV ratio of 80%, and your home is valued at $300,000, you may be able to borrow up to $240,000 ($300,000 x 80%).

- Income and Creditworthiness: Lenders assess your income, credit score, and credit history to determine your ability to repay the loan. A higher income and stronger credit profile may increase your borrowing capacity.

- Project Cost and Scope: The cost and scope of your home addition project will play a significant role in how much you can borrow. Lenders may require detailed estimates or quotes from contractors to assess the project's cost and determine the loan amount.

- Lender's Policies: Each lender may have its own lending criteria and policies. Some lenders may offer higher loan amounts or more flexible terms, while others may have stricter limitations.

Quick links

Ready to apply for a home addition loan? Get started.

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

Is it cheaper to build a new home or add an addition?

Whether it is cheaper to build a new home or add an addition depends on various factors, including your specific circumstances, the scope of the project, and local market conditions. Here are some considerations:

- Existing Home Value: If your current home has a high market value relative to the cost of construction, it may be more cost-effective to add an addition. This is especially true if you're satisfied with your current location and the overall layout and condition of your home.

- Land Availability: If you have ample land available on your property, it may be more feasible and cost-effective to build a new home rather than trying to fit a significant addition on your existing lot.

- Construction Costs: Construction costs can vary significantly based on factors such as location, size, design, materials used, and local labor costs. In some cases, building a new home from scratch may allow you to optimize construction methods and materials, potentially reducing costs compared to a complex and extensive addition.

- Design Complexity: The complexity of the design and the extent of modifications required to integrate an addition with your existing home can impact costs. Adding an addition that seamlessly blends with the existing structure may require additional design and engineering work, which can add to the overall expense.

- Permitting and Regulatory Considerations: Building codes, zoning regulations, and permitting requirements can differ between new construction and home additions. Depending on your location, one option may involve fewer regulatory hurdles or be subject to more lenient requirements, affecting the overall cost.

- Time and Convenience: Building a new home typically involves a longer timeline and more logistics compared to adding an addition. If time and convenience are important factors for you, adding an addition may be a more practical choice.

What are the pros and cons of home addition loans?

PROS

- Access to Funds: Home addition loans provide you with the necessary funds to finance your home improvement project, allowing you to proceed with your desired addition.

- Preserve Equity: By using a loan specifically for your home addition, you can preserve the equity in your home and avoid tapping into it. This can be beneficial if you plan to sell your home in the future and want to retain the value.

- Flexible Repayment Terms: Home addition loans often offer flexible repayment terms, allowing you to choose a repayment plan that fits your budget and financial situation.

- Potentially Lower Interest Rates: Depending on your creditworthiness, home addition loans may come with lower interest rates compared to other forms of unsecured loans, such as personal loans or credit cards.

- Tax Benefits: In some cases, the interest paid on a home addition loan may be tax-deductible. Consult with a tax professional to understand the specific deductions and benefits applicable to your situation.

CONS

- Interest Charges: Like any loan, home addition loans accrue interest charges, which add to the overall cost of the project. It's important to factor in the interest charges when evaluating the affordability of the loan.

- Debt Obligation: Taking on a loan means adding a debt obligation to your financial responsibilities. You need to ensure that you can comfortably manage the monthly payments alongside your other financial obligations.

- Potential Fees: Some home addition loans may come with associated fees, such as origination fees or prepayment penalties. Read the loan terms carefully and understand all the fees involved before committing to a loan.

- Impact on Credit Score: Applying for a home addition loan requires a credit check, which can temporarily impact your credit score. Additionally, if you miss or make late payments, it can negatively affect your credit score.

- Risk of Overextending: Carefully consider your overall financial situation and your ability to repay the loan. Taking on too much debt for a home addition can strain your finances and impact your long-term financial goals.

What credit score do you need for home addition financing?

The specific credit score required for home addition financing can vary depending on the lender and the type of loan you're seeking. Generally, a higher credit score increases your chances of qualifying for favorable loan terms and lower interest rates. While there isn't a fixed credit score cutoff, a good credit score is typically considered to be in the range of 670 or above.

However, it's important to note that credit score is just one factor lenders consider when evaluating loan applications. They also assess factors such as your income, debt-to-income ratio, employment history, and overall financial health. Meeting the minimum credit score requirement doesn't guarantee approval, as other factors play a role as well.

It's recommended to check with lenders or loan providers directly to understand their specific credit score requirements for home addition financing. Additionally, you can work on improving your credit score by maintaining a good payment history, minimizing credit card balances, and managing your overall credit utilization.

Home addition loan calculator

Total Payment

-

Total Interest

-

Monthly Payment

-

Ready to apply for a personal loan?

Compare rates from top lenders with no impact on your credit, ever.

How do I qualify for a home addition loan?

To qualify for a home addition loan, you typically need to meet certain criteria set by lenders. While specific requirements may vary between lenders and loan programs, here are some common factors considered during the qualification process:

- Good Credit History: Lenders typically look for a solid credit history, including a good credit score. This demonstrates your ability to manage debt and make timely payments.

- Stable Income and Employment: Lenders want to ensure that you have a stable source of income to make monthly loan payments. They may ask for proof of employment and income, such as pay stubs or tax returns.

- Debt-to-Income Ratio: Lenders evaluate your debt-to-income ratio, which compares your monthly debt payments to your monthly income. A lower ratio indicates that you have more disposable income to handle additional loan payments.

- Equity or Down Payment: Some lenders may require equity in your home or a down payment to secure the loan. This serves as collateral and reduces the lender's risk.

- Documentation and Paperwork: Be prepared to provide documentation such as identification, proof of homeownership, recent bank statements, and tax returns. Lenders use this information to assess your financial situation and determine your eligibility.

- Loan-to-Value Ratio: Lenders evaluate the loan-to-value (LTV) ratio, which compares the loan amount to the appraised value of your home. Lower LTV ratios may increase your chances of qualifying for a loan.

- Ability to Repay: Lenders assess your overall ability to repay the loan. They consider factors such as your income stability, existing debt obligations, and your debt-to-income ratio to ensure you can comfortably manage the additional loan payment.

How to get financing for a home addition

To apply for a home addition loan, you can follow these general steps:

- Research Lenders: Research and compare lenders that offer home addition loans. Look for lenders with favorable terms, interest rates, and loan options that align with your needs.

- Gather Documentation: Collect the necessary documentation for the loan application process. This may include identification, proof of homeownership, income verification (pay stubs, tax returns), bank statements, and any additional documents required by the lender.

- Pre-Qualification: Consider getting pre-qualified with a few lenders. This involves providing basic information about your financial situation, such as income and credit score. Pre-qualification can give you an idea of the loan amount you may qualify for and the interest rate you might receive.

- Complete the Loan Application: Once you've chosen a lender, complete the loan application form. Provide accurate and detailed information about your personal and financial situation.

- Submit Required Documents: Submit the required documents as specified by the lender. Ensure that all documents are complete, up-to-date, and legible.

- Review Loan Terms: Carefully review the loan terms, including interest rates, repayment period, fees, and any other conditions associated with the loan. Understand the total cost of the loan and the monthly payment amount.

- Loan Processing and Underwriting: The lender will process your loan application and perform an underwriting review. This involves verifying the information provided, assessing your creditworthiness, and evaluating the feasibility of the loan.

- Receive Loan Approval: If your loan application is approved, you'll receive a loan approval notice specifying the loan amount, terms, and conditions. Review the approval letter thoroughly to ensure you understand the terms.

- Loan Closing: Once you've accepted the loan offer, the lender will schedule a loan closing. At the closing, you'll sign the necessary documents and agreements to finalize the loan.

- Disbursement of Funds: After the loan closing, the lender will disburse the funds. The funds can be directly deposited into your bank account or paid to the contractor or supplier, depending on the lender's process.

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

Find Your Best Rate

Compare Best Personal Loans

Personal Loan Payoff Calculator

Personal Loan Lender Reviews

Personal Loans By Credit

Personal Loans for Fair Credit

Personal Loans for Good Credit

Personal Loans for Excellent Credit

Personal Loan Types

Auto Repair Loans

Credit Card Consolidation Loans

Fast Personal Loans

Home Improvement Loans

Horse Barn Financing

Wedding Loans

Family Planning Loans

Funeral Financing

Land Purchase Financing

Manufactured Home Financing

Medical Loans

Cosmetic & Plastic Surgery Financing

Owner Builder Construction Loans

Personal Loans for House Down Payment

Personal Loans for Self Employed

Personal Loans for Furniture Expenses

Student Loans

Debt Consolidation Loans

Vacation & Travel Loans

Emergency Personal Loans

Personal Loans with Co-signers

Home Improvement Financing

Appliance Financing

Bathroom Remodel Financing

Basement Remodel Financing

Boat Dock Loans

Deck Financing

Driveway Paving Financing

Fence Financing

Flooring Financing

Furnace Financing

Garage Financing

Home Addition Financing

Hot Tub Financing

HVAC Financing

Home Insulation Financing

Interior & Exterior Painting Financing

Kitchen Remodel Financing

Kitchen Cabinet Financing

Pole Barn Financing

Roof Financing

Solar Panel Financing

Swimming Pool Financing

Sunroom Addition Loans

Window Replacement Financing

Loan rate & terms disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.